The Top 6 New Prospects To Expect In Blockchain Frontier In 2020

Blockchain is having its time of popularity right now. Right after its creation back in 2008, this digital ledger started to become more and more recognized among the tech geeks first, and other individuals and industries slowly afterward.

Its main use is, of course, cryptocurrencies. Bitcoin, Litecoin, Ethereum – these are some of the most popular digital currencies that rock the financial industry today. Because of their decentralized nature, cryptocurrencies are fast, secure, and inflation-proof. Although, the problem of volatility isn’t entirely solved.

But blockchain has other uses apart from money. Some companies have started using it in their production and supply chains, others incorporated it to control their employee network, and so on. The point is, there’s much more to blockchain than meets the eye. And as we plunge into the year 2020, these use cases will become even more prominent. So, here are the six most predictable frontiers for blockchain in 2020.

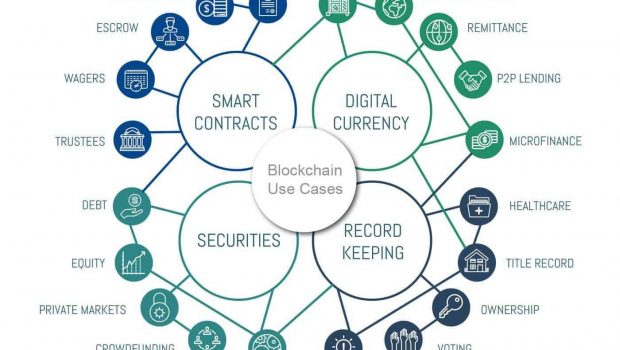

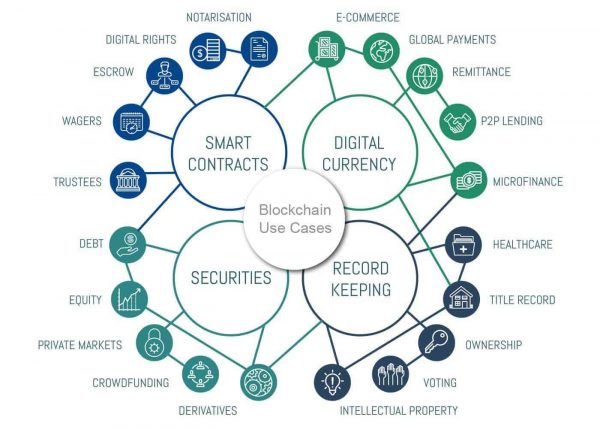

We need more apparent use cases

Image credits: The Money Mongers

This might be somewhat repetitive, but the blockchain industry is lacking the prominence of the apparent use cases. What I mean by that is that when encountering with this technology, entrepreneurs and businesses don’t really look into its other applications and go straight with the cryptocurrencies. That’s because other applications aren’t popular yet.

In 2020, there might and need to be new, more defined ways of using blockchain as a superior ledger over other database systems. Some individual, not-so-prominent examples won’t cut it – we need to see a bigger utilization of its powers.

Gaming and blockchain

The worlds of video games and online casino gaming are as vast and extensive as an industry can get. One generates almost $300 billion annually while the other – $94 billion per year. And their vastness can prove attractive to the blockchain startups.

Image credits: Ledger Insights

For example, Evolution Gaming casino technology is essentially a live casino that allows customers to stream games from the brick-and-mortar casinos from their homes. And this technology uses blockchain, more specifically, Bitcoin to feature a more protected and convenient payment platform.

But it’s not only about the casino industry. Video games might have an even bigger potential. You see, the current ones are filled with in-game purchases that lock many important functionalities away from the regular players. And many of them aren’t comfortable with spending too much money on skin packs, weapons, and other elements of the game.

Blockchain can be used to generate in-game tokens that will allow players to make additional purchases. As you might know, cryptocurrencies are generated by “mining” – using the computing power and electricity to make new tokens. This same method will greatly benefit both players and game developers, even allowing the parties to turn these in-game tokens into real money.

CBDCs destined to rise

One thing that’s apparent with the blockchain industry right away is that the world governments aren’t exactly fond of them. At least the majority of them. There are countries that outright ban the use and exchange of cryptocurrencies, while others restrict their use in the private economy.

However, when the competition from the private sector kicked in, when the governments saw the increasing potential of cryptos and stablecoins, they decided to barge in and make their own tokens.

Image credits: World Economic Forum

That’s when the idea about the central bank digital currencies (CBDCs) was born. Among the perceived advantages the governments are acknowledging blockchain’s effectiveness in enforced security, quick and convenient transactions, and efficiency in resource consumption.

So, the most recent developments on this front see China and Venezuela developing their own state digital tokens, however, as the year 2020 really kicks in, we ought to see some new nations step on this stage and make some noise.

High hopes of better security

One of the main things promised by the creation of blockchain and Bitcoin was their extensive security measures. Through cryptography, these innovative pieces of technology were supposed to protect their users from various cyber-attacks.

However, the real world turned out to be much more violent than it was initially painted. Just in 2019, more than $200 million was stolen from various crypto exchanges through cyber-attacks. And it’s highly possible that this number is even higher due to the unreported hacks. As the cybersecurity experts explain, blockchain isn’t inherently better at cyber-protection than its counterparts, some go as far as to claim that it’s even worse in some areas.

So, in 2020, many experts believe or want to believe that cryptographic practices will be far more superior than their previous versions.

China’s role is only going to increase

We already mentioned China on one of our paragraphs and it’s only suitable to dedicate one full section to this country. The reason is that the Chinese government has been overly vigilant, belligerent even, in its relationship with cryptocurrencies.

On the one hand, we’re seeing the RMB central bank develop its own digital currency and on the other, the government doubles down on crypto exchanges operating in the country. But perhaps if we stack these arguments against one another, we’ll be able to see a rationale behind their seemingly counterintuitive connection.

Image credits: The Coin Republic

And to be fair, there is a rationale. In an attempt to make its own digital token more rigid and widely used, China doubles down on the private sector. Bitcoin has seen some opposition in particular, and since its price reaches some wild volatility levels, the government is only going to reinvigorate its attempts to sink the most popular cryptocurrency, at least in China.

Bitcoin is coming back!

Okay, I mentioned at the beginning of this article that these future trends would include areas apart from blockchain’s financial use, however, this final point is still important because it reflects a peculiar trend in the industry.

I’m talking about Bitcoin and its reinvigorated market reach. When it was first created, almost no one knew about its existence, let alone its features and characteristics. For years, Bitcoin was struggling to gain popularity and enter mass adoption. There has even been a case of someone buying two pizzas with 10,000 bitcoins.

And from that dusk of unpopularity, Bitcoin reached its fame when the price for one BTC skyrocketed at $20,000 at the end of 2017. And since then, its price has been shifting back and forth, eventually stabilizing at around $7,000. But that’s the thing: for two years, Bitcoin was “stabilized” (with still major shifts in immediate price) at that point, slowly dying out of people’s attention.

However, at the beginning of 2020, we’re hearing stories about the new projects that use Bitcoin. And people seem excited about these projects too. For example, some experts consider Bitcoin to be drastically important for the development of Africa, promising to bring the continent to the forefront of the global economy and make it one of the main hubs for producing cryptocurrencies.