How to Exchange Crypto for Cash: The Pros and Cons of Different Methods

With the evolution of cryptocurrency and more and more people embracing it, people now need to know how to exchange Bitcoin for cash. As the rise in popularity of leading cryptocurrencies such as Ethereum, Bitcoin, and many others continues to soar, people are now seeking reliable methods to exchange Bitcoin for cash. However, each of these methods of cashing out crypto has different pros and cons, and you must choose the one that works best for you carefully.

Reasons why people exchange crypto for cash

There are several reasons why people might want to exchange crypto for cash, including:

Access to fiat currency

Many businesses and private individuals still do not accept crypto payments and require people to pay in cash. Also, people need to have some money for daily expenses, paying bills, or just because it is the preferred payment mode in their country.

Investment diversification

Some investors may wish to have their investments spread out in various assets and investment vehicles other than cryptocurrencies. This is to reduce the risk of crashes affecting their crypto assets. As such, those people may look for a way to exchange their crypto for cash so they can invest their wealth elsewhere.

Volatility mitigation

One of the key issues with cryptocurrencies is that they can be highly volatile. Some investors may exchange crypto for cash to protect themselves from potential losses in case of market fluctuations. They may also want to lock in profits by holding their wealth in less volatile assets.

Preference for tangibility

Because cryptocurrencies are virtual or intangible assets, some people may need more time to feel comfortable when they hold their assets in them. Consequently, such individuals may consider exchanging crypto for cash, which is tangible and more stable.

To deal with emergencies

In some emergency or unforeseen situations, people may require immediate cash. Thus, cashing out crypto could be the best and quickest option to meet those needs.

Regulatory compliance

Different regions have varying regulations relating to cryptocurrencies. In some circumstances, people may be required to exchange crypto for cash to comply with legal requirements or tax obligations in their jurisdictions.

Methods of converting crypto for cash

There are several methods you can use to exchange crypto for cash, and below are some of the major ones:

Cryptocurrency ATMs

Crypto ATMs are automated machines that are similar to conventional cash dispensing machines. Crypto ATMs allow people to buy or sell digital currencies. If you are looking for a convenient way to exchange crypto for cash, these machines are your best option.

Pros:

- Accessibility: with the increased adoption of digital currencies, crypto ATMs are becoming more available in different locations, especially the high-traffic areas such as malls, airports, and so on.

- Convenience: These machines offer an immediate and straightforward method for exchanging crypto for cash, just as traditional bank ATMs help people access their money quickly.

- Anonymity: some crypto ATMs allow users to buy or sell crypto without a need for identity verification, which enhances privacy.

Cons:

- Limited availability: there is still only a limited number of crypto ATMs in most places across the globe, making accessibility limited for the majority

- Higher fees: crypto ATMs charge higher fees than online exchanges and other methods. This significantly affects the overall cost-effectiveness of the crypto transactions.

- Lower limits: these machines may have far lower limits for amounts that one can transact at a time, which restricts those who want to transact huge quantities.

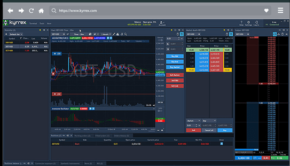

Crypto exchanges

Exchanges are the primary platforms that facilitate the trading of digital assets. While most crypto exchanges have online platforms, some also have physical offices that buyers can walk into and out and transact their crypto in a secure environment. Also, exchanges offer users optimal security and convenience, as they support many crypto and allow people to receive cash in different methods.

Pros:

- Accessibility: crypto exchanges are easy to access and allow users to cash out their cryptocurrencies faster.

- Variety of currencies: exchanges support many cryptocurrencies as well as fiat pairs, offering customers great flexibility as they trade.

- Liquidity: Many well-established exchanges are highly liquid, allowing users to readily buy or sell crypto coins at market prices.

Cons:

- Verification requirements: some exchanges have stringent anti-money laundering (AML) and Know Your Customer (KYC) procedures, which make it mandatory for customers to undergo a detailed verification process that may take time and delay transactions.

- Fees: crypto exchanges often charge various fees such as withdrawal, trading, and other fees which affect the overall profitability

- Security risks: centralized exchanges are prone to hacking attempts, potentially putting the users’ funds at risk.

Peer-to-peer platforms

Some platforms such as Paxify, LocalBitcoins, and others connect buyers and sellers so they can trade between themselves at some agreed terms, including prices, modes of payment, etc. You can use P2P platforms to exchange crypto for cash, and these platforms can help you find buyers with whom you can meet and transact.

Pros of P2P platforms

- Privacy: users can enjoy more privacy than when using crypto exchanges. P2P platforms allow them to negotiate terms directly.

- Accessibility: these platforms are easy to access, enabling users to convert their crypto to cash without hassle.

- Variety of currencies: users can choose from many fiat and digital currencies, offering them flexibility in trading options.

Cons of P2P platforms

- Lack of regulation: due to their decentralized nature compared to traditional exchanges, P2P platforms lack proper regulatory protection.

- Price discrepancies: there could be wide discrepancies in transaction value because the prices on these platforms are negotiated between the buyer and seller and they can differ significantly from the market rates.

- Security concerns: With these platforms, there is a higher possibility of dealing with scammers or fraudulent users, which calls for thorough counterparty vetting.

Conclusion

There are many reasons why people and institutional investors may want to exchange crypto for cash. No matter the reason, choosing the most suitable cash out method is crucial. Some ways to liquidate your crypto include crypto ATMs, traditional crypto exchanges, and peer-to-peer platforms.

As you choose the method to use to exchange your crypto for cash, you need to consider the pros and cons of each approach and pick the one that meets your needs and goals. You must consider the security of the method you choose and the fees it charges to ensure it makes economic sense using it and you don’t risk your funds and crypto assets.