Invest in These 5 ETFs for Exposure To Disruptive Technology

With the U.S. economy heading in the right direction, many people wish to invest in ETFs which are high-quality, disruptive, and can give portfolios exposure to companies on the cutting edge of technology. Investing in the right ETFs can offer dramatic opportunities and has the potential to transform existing industries, products, and services to adapt to the changing future economy.

If you are interested in adding artificial intelligence, robotics, or biotech to your accounts, check out these five disruptive ETFs with impressive performance ratings to expand your portfolio.

Image by Freepik

What Are Disruptive ETFs?

Technology is rapidly changing how we live and interact in our daily lives. From communication to travel, business innovations, food, healthcare, and shopping services, revolutionary technology is causing radical shifts in technology use.

Exchange-Traded Funds (ETFs) involved in these booming and innovative technology sectors allow investors to tap into their growth potential.

Unlike traditional stocks like Apple (NASDAQ: AAPL), Facebook (NASDAQ: FB), or Amazon (NASDAQ: AMZN), disruptive ETFs like ARK Innovation (NYSEARCA: AARK) are making waves not only with stellar performance but also as large, thriving, multi-cap ETFs.

Influential, disruptive technologies represented by ETFs include artificial intelligence (ai), the internet of things, blockchain technology (used in cryptocurrency, banking, and healthcare systems), virtual and augmented reality, and e-commerce platforms.

What are the Six Kinds of Disruptive ETFs?

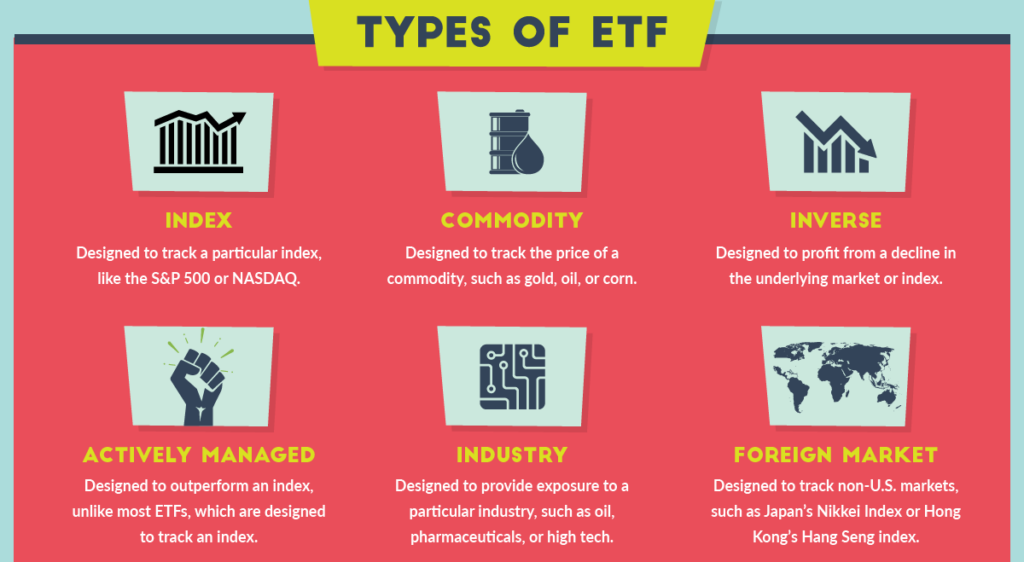

Innovative technology ETFs can typically be divided into six different kinds that include:

- Equity Funds: investments primarily in stocks.

- Real Estate Funds: a mutual fund that invests in securities such as dividend-paying REITs held by public real estate companies.

- Currency Funds: typically divide at least 80% of assets into cash and bonds. Currency funds track the base performance of one currency, such as the U.S. dollar, and compare it to a collection of foreign currencies.

- Commodity Funds: investments in agricultural products or raw materials, including gold, silver, oil, natural gas, energy resources, and grain.

- Fixed-Income Funds: include savings bonds, Treasury bills, Bankers Acceptances, NHA Mortgage-Backed Securities (MBS), Guaranteed Investment Certificates (GIS), and laddered portfolios.

- Specialty Funds: a type of mutual fund that focuses on a specific economic sector or industry and can include a broad sector or a specialized industry group that might concentrate on environmentalism or diversity, alcohol, tobacco, weapons, or the military.

Invest in These Five ETFs for Exposure to Disruptive Technology

1. ALPS Disruptive Technologies ETF (DTEC)

Expense Ratio fees: 0.50% or equivalent to $50 annually per $10,000 invested.

If you’re like many investors, you would like to gain exposure to innovative new technologies but are still undecided about which sector you would like to focus on.

If you are new to disruptive ETFs, it is also a good idea to start with the one that involves minimal individual stock risk.

That is why the experts at NASDAQ.com consider ALPS Disruptive Technologies EFT a winner.

The great thing about DTEC is that it offers equal fund weightings. This significantly lowers the risk for any single stock within this fund.

If you are interested in investing in artificial intelligence, healthcare, data, or fintech innovation, DTEC has you covered.

The fund includes disruptive themes such as cloud computing and analytics, AI, 3D printing, mobile payments, banking fintech, cybersecurity, robotics, and the Internet of Things.

ALPS DTEC conforms to the Indxx Disruptive Technologies Index. This means that member companies must generate at least half of their revenue from a disruptive theme or technology.

With DTEC, you will not only find a complex and generally low-risk ETF, but it is also a growth fund. This means that you will need to pay upon valuation. Fortunately, DTEC has not historically averaged as a costly ETF.

2. ARK Autonomous Technology; Robotics ETF (ARKQ)

Expense Ratio fees: 0.75%

If you’re looking to invest heavily in a stock that includes Tesla, then the ARKQ Autonomous Technology; Robotics ETF (NYSE:ARCA) might prove a welcome addition to your disruptive portfolio.

While ARKQ does allocate 11.35% of its weight to Tesla stock, this tech fund offers many other disruptive elements.

Investors interested in rapid-growth automation and robotics can receive exposure to multiple disruptive themes, including autonomous transportation, 3D printing, clean energy companies, and space exploration technologies.

The good news is that ARKQ’s active management means that the fund allows the manager to transition inside themes. This has the potential to benefit long-term investors. In addition, ARKQ’s combination of TESLA and automation themes means that it offers some exciting and possibly profitable technological developments.

As vehicles become more automated and dependent on sensors that affect traffic, in-car and exterior entertainment will continue to develop. At the same time, data and human information, live health monitoring, goods, and hospitality services continue to expand rapidly.

How information and services are delivered will impact the value chain at individual and corporate levels. This means that companies that combine multi-themes have the potential for expansive growth.

3. Global X Cybersecurity ETF (BUG)

Expense Ratio fees: 0.50%

You have probably noticed the growing need for cybersecurity. For example, information must be kept accurately and securely from foreign government hacks to fintech data security. As a result, both the government and the private sector report increased spending in the cybersecurity area over the past several years.

Here is where the Global X Cybersecurity ETF steps in. It debuted in October 2019, just months before the global pandemic.

It has demonstrated advantages over the past year that include lower fees than competitive and larger rivals and a mid-cap range.

BUG is a widespread catalyst in cybersecurity stocks and funds despite its relatively recent appearance on the scene.

Due to the current glut of cybersecurity companies, some experts think that many of BUG’s mid-cap sections might prove ripe for consolidation in the future.

4. Global X Internet of Things ETF (SNSR)

Expense Ratio fees: 0.68% per year

Another interesting ETF to check out is the Global X Internet of Things. Like DTEC, SNSR also conforms to the Indxx mandates.

Connectivity is a buzzword that investors have heard a lot about lately.

It is no secret that the world is growing smaller at our fingertips. We are connected in new ways as never before.

This can relate to 5G networks, smart devices, data processing, user interface, or other connectivity infrastructure.

Some market observers believe that tens of billions of devices will connect online over the next few years.

As people and things connect more, this will affect nearly every type of global industry. Manufacturing, transportation and mobility, food industries, retail companies, and the healthcare sectors will find themselves at the forefront of these massive social and technological changes.

SNSR’s involvement with 50 different holdings in disruptive technology indicates that it spans this multiverse of development and manufacturing that includes sensors, semiconductors, integrated solutions, and tech applications that service developing smart grids, smart homes, appliances, connected cars, and industrial internet functions.

5. ROBO Global Healthcare Technology and Innovation ETF (HTEC)

Expense Ratio fees: 0.68%

Healthcare can seem like a dull investment sector compared to cybersecurity or robotics. But disruptive technologies are booming at the center of the healthcare industry.

Technology has revolutionized biotechnology, particularly a high-tech blend of robotics, mechanical intelligence, and life sciences.

From artificial intelligence diagnostics to barely invasive robotic surgery, from 3D printed implants, assisted mobility, virtual visits, and molecular analysis to genetic cancer therapies or DNA sequencing, health and pharmaceutical technology are creating medical breakthroughs changing how people receive health care.

The Takeaway

Disruptive technologies are here to stay. From distributed ledger systems like blockchains, data, fintech, and artificial intelligence, to connected cars to wearable technologies, disruptive technologies will impact nearly every aspect of our lives in the future.

Wall Street closely observes companies at the forefront of disruptive technologies and recognizes that they will play a vital role in the future global economy.

Due to complex innovations and rapidly shifting environments, disruptive technologies may represent unpredictable elements or volatile markets. Yet, at the same time, they represent a fast-growing and vital sector for future connectivity with massive potential for benefits and growth.

![[NSFW] Infographic – How Porn Drove Innovation in Tech](https://technofaq.org/wp-content/uploads/2015/02/prnography-tech-innovation-150x150.jpg)