Bullish VS Bearish – What’s the Difference

Over a few years in the past, financial trading is in the rage. To protect themselves from financial insecurities, many amateurs dive into financial marketing. Those who are determined about financial investment procedures, should be ready to face some financial challenges then and there.

Once stepped into the trading forum, the investor needs to get familiar with this domain as soon as possible. Every business owner should follow the sound investment objectives. Right? To follow the market structure in depth, the individual should make the effort to understand the strange market lingo. Two of the most used lingos are bullish and bearish and it is important to understand – bullish vs bearish!

Allow Financial Experts to Clarify Bullish VS Bearish

Professionals dealing with corporate finance play a major role in guiding the investors. Their proficiency levels add an edge to the confidence in investment patterns of users. They intend to make more rational investments rather than emotional investments.

Bullish means up and bearish means down. Both of them are two different types of investment patterns. Is it more confusing to choose the bullish vs bearish market? However, your market strategy will pave the path. Well almost the majority of the investors go for the bullish while some look forward to the bearish investment patterns.

All You Need to Know Between Bullish VS Bearish

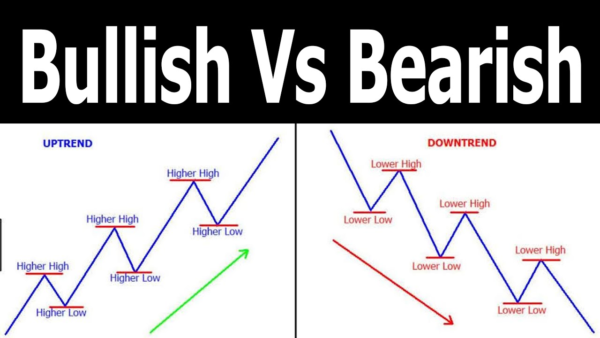

It’s more crucial to understand the basics of the investment market. To narrow down the concepts of bullish and bearish, the two terms result in the positive and negative price movements. The optimistic traders go along with the more popular approach known as the bullish market. Bullish means prices will automatically go higher from the existing market profile. The confident investors believe that this is a long-term pattern and it takes place because of the macro-economic condition and inflation. To initiate the scaling of stock prices, traders can refer to potential methods such as call options, and buying stocks.

To trade more on the bullish market vs bearish market, you need to know what does bearish refer to. Those who are fascinated over the short term gains, always jump into the bearish market. The bearish traders need to capitalize in a short span of time. The bearish investors experience steady market gains as well as they should be ready to face the downturns of the business.

How Are These Concepts Named?

Till today, the practice of naming the investment patterns while referring to animals is still going on. This has led to these two specific expressions such as bullish and bearish, referring to investors and stock traders. In fact it casts a picture of how the bears and bulls fight against their enemies.

So, after a bull attack, its horns thrusts upward and your market will go up. On the other side, a bearish attack is just the opposite and it swats downward. Investors may expect the downturns will occur.

Definitions of the Two Terms

To draw a deeper understanding between the bullish vs bearish market, the bull market is known as the uptrending market. These types of markets last while featuring longerprice rise and are more powerful than the bearish markets.

A declining market is better known as the bear market. In this market scenario, overall stock prices start to decline and the sellers enjoy the stand in the market.

When it comes to settling between bullish vs bearish, it becomes indispensable to cite the characteristics.

Characteristics of Bull and Bearish Market

As said, the bull markets are highly responsible for tending upward profits. While trading in the bull market, you would find that there is low unemployment and there is stability in social life. People are able to spend a lot of money, seek stable oil prices etc.

The bearish market sheds the opposite side of it. During this time, there is less stability in the global economy and international tension starts rising. It becomes difficult to make steady profits in business because uncertainties loom everytime.

How to Trade Between Bullish vs Bearish Market?

Trading through any market condition remains a challenge to the investors. T. Start recognizing the patterns of investments considering bullish vs bearish because they mostly remain the same for a long time. Indeed, the patterns can work depending on the trends of the market.

Specifications of Market Changes

If there are enough sellers to bring the prices down, you will be able to notice the business patterns more. In reality, it becomes hard to predict the changes. Due to recessions and crises, the selling gets slow and the market attains a different entry. So, instead of consulting with your financial guru, try to focus on reading about specific investment patterns and understand the trending topic of bullish vs bearish.

The Bottom Line

Market prices will go up and down. Hence, start knowing the nitty-gritty of each investment pattern at financeshed. You will often find that these business terminologies like bullish and bearish are used interchangeably. It is because this depends on the investment patterns, and durations.

The bullish vs bearish refers to one of the most talked about topics in the world of investment and knowing these will lead to your future success. Go for the right market pattern according to your needs and make the most out of indicators, stock, and market. Never try to predict before and start accepting whatever comes in your trading process!