Everything you need to know about Low Doc Property Finance Sydney

Banks and financial institutions now leverage different types of financial assistance, but for the self-employed or a contractor, loan assistance may get a bit tougher, especially if you are borrowing the loan from a traditional bank. Conventionally, you need to meet the checklists levied by the bank. The borrower needs to prove their income, maximum assets, minimum liabilities, and proof of stable long-term income. To avert hindrance in the process of acquiring loans, one must consider for low doc property finance. There are many Australian lenders who can lend money to meet your needs. The low doc property finance Sydney is a major boon for new entrepreneurs, who can initiate a new business at the lowest hassle.

What do we understand by a Low Doc Property Finance

The term ‘Low Doc’ is self-explanatory, it means that such loans can be availed even with lesser documentation. It is ideal for those borrowers, who have no PAYG payslip records or cannot provide financial statements and tax returns. Usually, the borrowers who don’t have all the documents, or they don’t have a steady flow of income they opt for the low doc property finance Since, a traditional bank asks for full-proof documentations like income tax returns, the profit and loss balance sheet of your company or a conclusive financial document by the accountant. Don’t miss to compare the interest rates, mortgage, repayments or fees of the various low doc finance group, before borrowing the loan.

In low doc loans, the borrowers may be compelled to pay a bigger deposit and a much higher rate of interest. The scenario is quite different in tradition bank, which requires you to meet their prerequisites to get a loan at reasonable interest rates. Today, the low doc property finance has transformed from a niche market to mainstream nonbank loan lenders that is much sort after, especially for a mortgage loan. This mode of the loan payment is unique and crafted for contractors, APN holders and entrepreneurs.

The Basic Document required for a Low Doc Finance

It is true that low doc property finance is available for those who can’t prove their income through conventional means. However, they need to submit the following documents to avail for the loan. Some finance companies require only two documents; others may require more. Make sure you do your research well, before opting for their service. The common documents required are as follows:

- Borrower’s Income Declaration stating your usual income, signed by you

- Your registered business name

- Your Australian Business Number (ABN)

- Your Business Activity Statements (BAS) for the last 12 months

- Some financers may require you to confirm that you have been registered for GST for at least 12 months

Keep these documents in hand, when you approach for low doc property finance. The above documents will act as a self-certification of income for the borrower to gain some credibility. This basic paperwork cannot be ignored. The documents required are minimalistic, but the cost of repayment can be more.

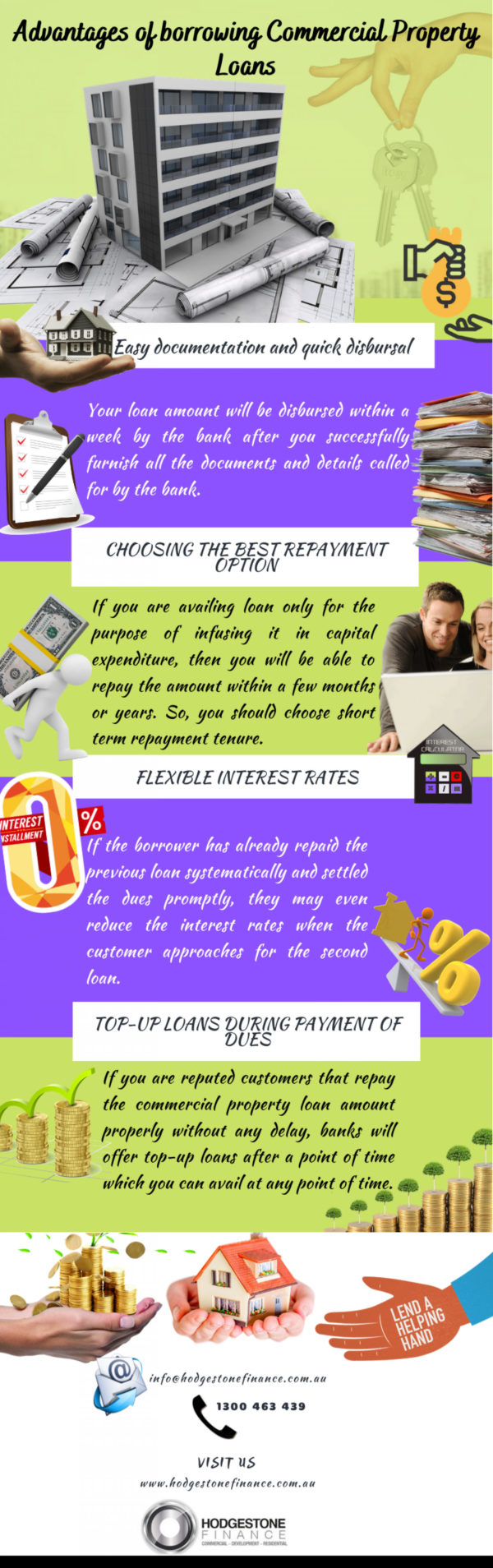

Benefits of Low Doc Property Finance

- Faster access to loan even with fewer documents

- Self-employed candidates with equity or saved deposits can apply for a hassle-free loan

- The application process is much easier and less stringent as the traditional banks

- Alternative documents are acceptable to prove your source of income

- Nonbank lenders are available to cater to your need

Conclusion

We can conclude by saying that low doc property finance does not mean no documents are required for acquiring a loan. It simply means that the loans are available at less documentation, and you have enough assets to repay your loans. Lenders are open to lending money to those who can provide self-certification from the credentials available to them.