Most Profitable Apps

Apps can earn their developers billions of dollars. Yet, most of the financial rewards are won by certain kinds of apps, while many others end up in the red, however cool they may be.

In this article, courtesy of our friends from Belitsoft (an offshore app development company) we will talk about the most profitable app niches as well as reveal some factors that contribute to their success.

Music & video streaming

When it comes to financial gains, music and video apps are in their prime.

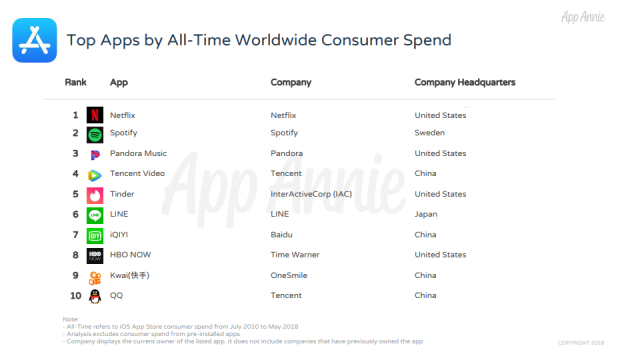

Last year, AppAnnie, a mobile data and analytics firm, published a retrospective of the most successful iOS apps since the platform launch. Impressively, almost all of the top-grossing apps were based around some kind of streaming services.

The trend continued through 2018 as well, with 8 out of 10 apps that provide streaming functionalities making the most revenues worldwide. The charts-leader Netflix has now made more than $1.58 billion on mobile around the world since it began monetizing in 2015.

According to SensorTower, in 2018, mobile users spent $1.27 billion on top 10 subscription video on demand (SVOD) apps in the US alone, a 62% growth from 2017. Combined, they made up 22% of the total non-game app revenue in the US. On the global scale, the top 5 video streaming services got over $2.2B in 2018.

Remarkably, the top 5 lucrative apps in the world offer in-app subscriptions, that encourage users to spend money to get access to premium functionalities.

‘The rise in subscription app engagement is a boon for developers, as the subscription app model provides them with more consistent revenue streams. That’s because subscription apps generate revenue from recurring weekly or monthly payments from established consumers, rather than unpredictable, one-off purchases, for example.’ 2018 Liftoff App Engagement Index.

This monetization model is especially beneficial for apps that offer dynamic content – video, music, news, dating services, etc.

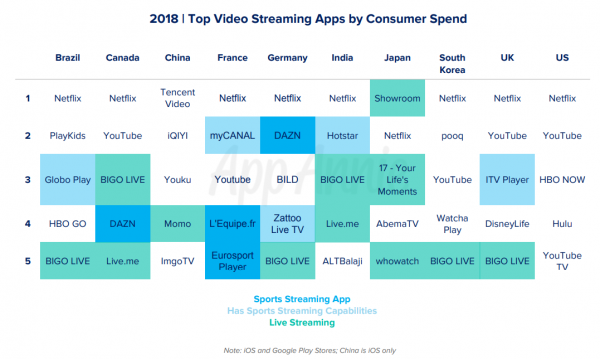

Apart from Netflix and other apps of this kind, sports streaming gets a large chunk of users preferences, especially fueled by international events like the 2018 Winter Olympics and FIFA World Cup 2018.

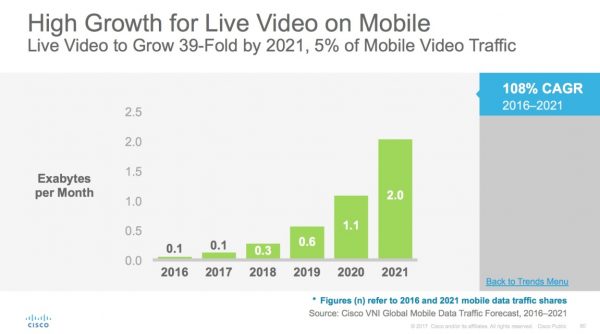

Video has also become a standard feature for many social networks and messengers. This demand has been largely fueled by the rise of apps like Tik Tok, Instagram, and Snapchat.

Indeed, 80% of people are more likely to watch a live video from a brand than read a blog, while 82% prefer live videos to social posts.

Be it short-form videos, live streaming or video calls, enabling user-generated content increases audience coverage and engagement.

Dating apps

With more than $816 million in gross revenue, Tinder occupies top positions on the world app arena, coming right after Netflix on both app stores in terms of consumer spends.

The app also dominates both worldwide and the US 2018 dating app rankings, bringing more than 59 percent of the top 10 dating apps earnings.

The second overall money-making dating app was Bumble, with Badoo, Tapple, and MOMO breathing down its neck.

According to Gary Swidler, CFO of Match Group, that owns Tinder, most of the app’s revenue is driven by the adoption of its subscription-based premium version, Tinder Gold.

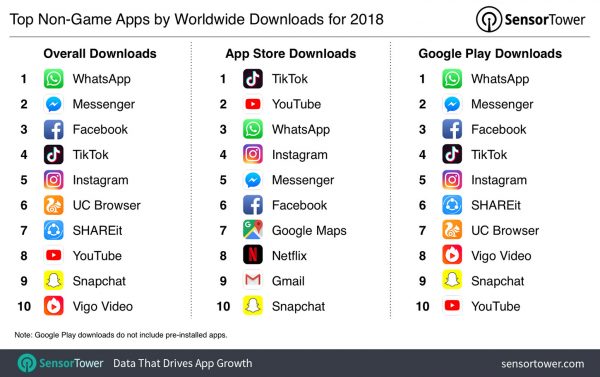

Meanwhile, social networks and messengers occupy the most downloaded apps charts in both overall 2018 and the all-time App Store list.

Health & fitness apps

Mobile users spent an estimated $327 million in the ten top-grossing Health & Fitness apps both on AppStore and Google Play worldwide. This is 61% more than the top 10 apps got during 2017.

As seen from the chart, the most-earning apps of the category belong to one of the four groups:

- Mobile fitness coaches and videos

- Calorie and diet trackers

- Meditation coaches and audio guides

- Running workouts plans and trackers

The gross revenue of the most lucrative Health & Fitness app, Calm, was estimated at more than $63.6 million in 2018 and increased by 277% over the year. The growth increased the app’s rating by four spots to replace Sweat.

Apple has also included Calm in the list of the best apps within the self-care subcategory, which was officially named the trend of 2018 on iOS. The top-rated apps included tools for meditation and building better lifestyle habits:

- Fabulous – Daily Motivation,

- Calm,

- Shine,

- 10% Happier.

People start to realize that mental fitness is as important as physical activities.

“The brain is the key muscle in our body, and just like we go to the gym to strengthen our biceps, we can leverage tools like meditation to strengthen our awareness and our minds, ultimately helping us to focus better and ease anxiety and stress,” Alex Will, Chief Strategy Officer at Calm, explains.

As for fitness apps, they are predicted to prosper steadily as people are becoming more mindful of their physical health. The users are particularly attracted to the apps that offer capabilities like online communities. They serve as social networks for athletes with virtual rewards for completing certain activity goals. As Technavio’s analysts suggest, the global market for fitness apps will grow at a CAGR of around 31% until the end of 2020.

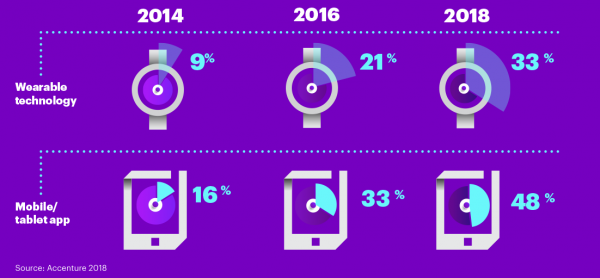

The demand for such apps among women is seen as the critical driver of industry success. Accenture also noted that the adoption of wearable devices impels proportional growth in health & fitness apps users.

Games

Despite the wide variety of non-gaming apps for any goal and budget, more money are spend on games than on any other category. In 2018, mobile

gaming’s share of all app revenue amounted to nearly 77 percent.

All the 10 top-grossing mobile games are free to get, offer in-app purchases, and can be downloaded both from Google Play and App Store. Most of the games are also available in a multiplayer mode, creating the environment for better user engagement.

In general, more involved games require more effort and costs to make the user go deeper into the funnel, but the payoffs are mostly worth it. At the same time, less challenging games with fewer expenses have many more market competitors vying for users’ loyalty.

Key takeaways

- Music and video streaming apps prove to be the most lucrative in the non-gaming sector and occupy the majority spots in the top 10 highest-earning apps worldwide. Most of them operate on a subscription basis.

- Dating apps are a goldmine, with Tinder coming right after the world-leader Netflix in term of revenues.

- Health and fitness apps market is booming, led by the apps for fitness coaching, calorie tracking, meditation and running.

- Games retain the revenue leadership across all categories, with consumer spending higher than on all non-gaming apps.