From Contactless Cards To E-Wallets And “Tap-To-Pay” Mobile Payments: Here’s How You Can Make Transactions In 2018

Almost every individual has gotten around using mobile banking apps to make transactions whether it is shopping or paying bills, as well as to send/receive money on a daily basis. Although the credit and debit cards are still pretty much in use, mobile commerce has paved the way to new payment methods, further facilitating digital transactions.

Types of Payment Methods Available Today

Being able to make online payments from a laptop or desktop computer was the biggest thing to happen in commerce in the early 2000s. Making transactions online, through the internet, thanks to the use of electronic cards was revolutionary! But only a few years down the line, online transactions became even more facilitated with the technology of smartphones and smart devices.

Today, billions of people around the world, use various means to make online transactions including contactless payment methods, such as through the use of handheld devices or wearables, or peer-to-peer payments, such as through the use of mobile apps.

Contactless Payment

Contactless payment systems using cards and other devices such as smartwatches, have been in use for a few years now and in places like the UK, they are at an all-time high. The ease and speed of making transactions with contactless cards are what make them so convenient. However, the problem with these cards is that they are capped.

Since there is no way to verify your identity when making a payment using contactless cards, (such as entering a pin or signing a receipt), it is fairly easy for anyone to steal or find, and use your card without problems.

For this reason, the money available on contactless cards are capped to a fixed number. In England for instance, contactless cards are capped to £30 because of security-related issues.

Peer-To-Peer Payments

Peer-to-peer payments are transactions made through an intermediary application. This means that of using your credit card details to make an online purchase, you use an application to deposit your money into, (therefore serving as an e-wallet), to then use the money you deposited in that application to make the transaction.

This method of payment is very secure because the way they work enables users to keep their banking details confidential in that they are never shared with the seller or website they are making a purchase from.

This way, instead of sharing your banking details with each and every website you would like to make a purchase from, all you have to do is use one secure app that will act as an intermediary between you and the seller. What you do is you deposit money into your account, and then pay the seller with that money.

Does this sound familiar? It should very well by now because one such example of this is Paypal. Paypal’s been around for a long time and has proven to its users that it is efficient and safe, and can be easily managed online or by using their app. Not only that but, Paypal is also widely accepted websites, plus it is also used as a means to send and receive payments from other users.

There are many other apps that are similar to PayPal that also combine with the use of contactless payments. One such example is ecoPayz. This payment method allows the user to make online transactions like PayPal through the ecoPayz app by first creating an ecoPayz account. But, users can also make contactless payments thanks to the ecoCard.

Once the user deposits money into their ecoAccount, they can either make online payments through the ecoPayz app or use the ecoCard at stores. But is it safe? Just like Paypal, ecoPayz has also been around for some time and has been used at both land-based stores as well as online stores. Nowadays, ecoPayz is also used at online casinos.

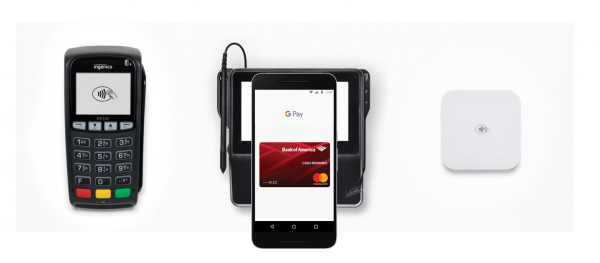

Apple Pay, Samsung Pay, and Android Pay

All these three mobile payments are a form of peer-to-peer payment method that works with a smartphone. Each type of smartphone has a system for itself, hence why we’ve listed down each one specifically. Thanks to these methods, people can make faster and smoother transactions by “tapping” their phones on the NFC reader at the store.

There are no apps involved this time; all you have to do is scan your credit card once using your mobile phone, and your details will be saved. With regards to safety and security, in order for a payment to go through, your phone has to be unlocked. If it is locked, you will have to confirm your identity with your fingerprint on the touch ID or enter a 16-digit number generated every time you want to make a purchase.

Moreover, if the NFC signal is intercepted or there is a company breach, no valuable information can be stolen since your personal information is never transferred when making a payment because this method works with a tokenization system.

So now, if you want to walk into a store and make a quick purchase, you can just whip out your phone, tap it against the reader and have your transaction ready in seconds. This method is fast, convenient and easy to use but – on the downside, although it’s been around for a few years, the number of stores that accept it is still pretty low.

Closing Thoughts

Now that we’ve seen different options for making payments in 2018, we can’t help but speculate what’s in store in the next couple of months. Although all these payment methods are currently being used, some are more widely used than others. What we are betting on though, is that the use of these payment methods will continue to increase!