The Dummies Guide to Unsecured Credit

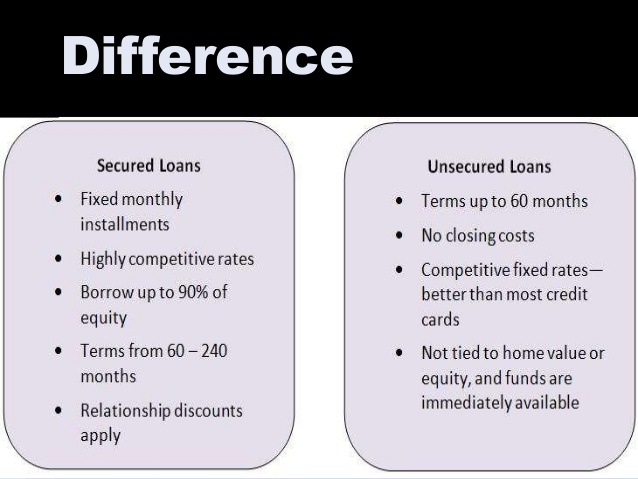

Today’s financial business etiquettes dictate that for every transaction that’s made, there must a collateral of equal value that should be handed down to each of the two parties involved in the transaction. And this is generally the way that everyone does business. So imagining a situation where the transaction is made for no collateral to sate another party seems highly plausible but this practice indeed exists.

Enter Unsecured Credit

So what exactly is unsecured credit?

One can say, in layman’s terms that unsecured credit is a kind of transaction where a financer does not have a collateral to protect his investment. In more complex terms, Unsecured Credit can be defined as credit which is not collateralized by an asset and this when unpaid cannot be recouped with any form of asset seizure from the other party. On top of that, in many instances there is no legal decree that is in place when such payments are issued so the creditor cannot go to any law enforcement commission to file any form of legal complaint.

Unsecured credit is most relevant in case of transactions made by family or friends where is there is no time limit or guarantee when one can expect their money back.

Despite the risks involved, this is actually quite a common practice in business and many organizations use such means to finance their operations. This is especially relevant in case of budding entrepreneurs, who have no startup capital to finance their operations and often resort to investments from friends or family or in a cases, few shady loan sharks for startup investments. The fact that unsecured credit is easy to acquire makes it a very tempting proposition for most as they aren’t bound by legal pressure and can focus on the business and maximizing its efficiency.

Means of obtaining Unsecured Credit

Unsecured credit comes in many types, most being a form of loan to another person via some means or another. Stated below are some forms of unsecured credit loan types:

- Credit Cards: A credit card is one of the first and foremost form of an unsecured loan. A credit card essentially allows you to “borrow” money from the credit card company and pay them back at a later date. The risk involved being that the Credit Card Company cannot be absolutely sure that they’ll get back the loaned sum at the exact specified date.

- Payday Loan: A payday loan is a popular from of unsecured credit. A payday loan is generally issued by a non-financial business entity. People generally take a payday loan when check Cashing San Jose is not possible due to not receiving their paycheck in time and need to cover their expenses for the time period. Payday loans do come with a caveat though. Being issued from a non-financial entity, the interest rates can sometimes be exorbitantly high for a relatively short duration.

- Signature Loans: Signature loans are generally issued by banks and credit unions. These loans are called ‘Signature Loans’ because you only need to sign to secure yourself a loan. The loan is issued in installments and due to their lower interest rates, they make an attractive proposition for first time borrowers. The signee only needs to promise the bank that the loan will be repaid in due course of time with a fixed rate of monthly installments as specified by the issuing institution.

- Cash Advance: A cash advance is a type of short term loan that can be issued from a bank. This type of advances are generally issued to credit card holders allowing them to take short term cash advances without much hassle. Cash advances come in two forms:

1. Based on one’s income

2. Based on one’s credit rate

Similar to any unsecured loan issue, cash advances require a faster turnaround and has a very high rate of interest.

- Student Loans: Student loans are a form of unsecured credit too. Depending on the financial institution, the period for repayment may vary vastly. Like any other unsecured loan, student loans don’t require any form of previous credit history from the borrower and offer attractive rates of interest fitting all budgets.

One crucial thing to remember while taking student loans is that to make well-informed decisions. Careful market research is necessary to get the best possible deal, albeit, one with the lowest interest rate and easiest payment structure.

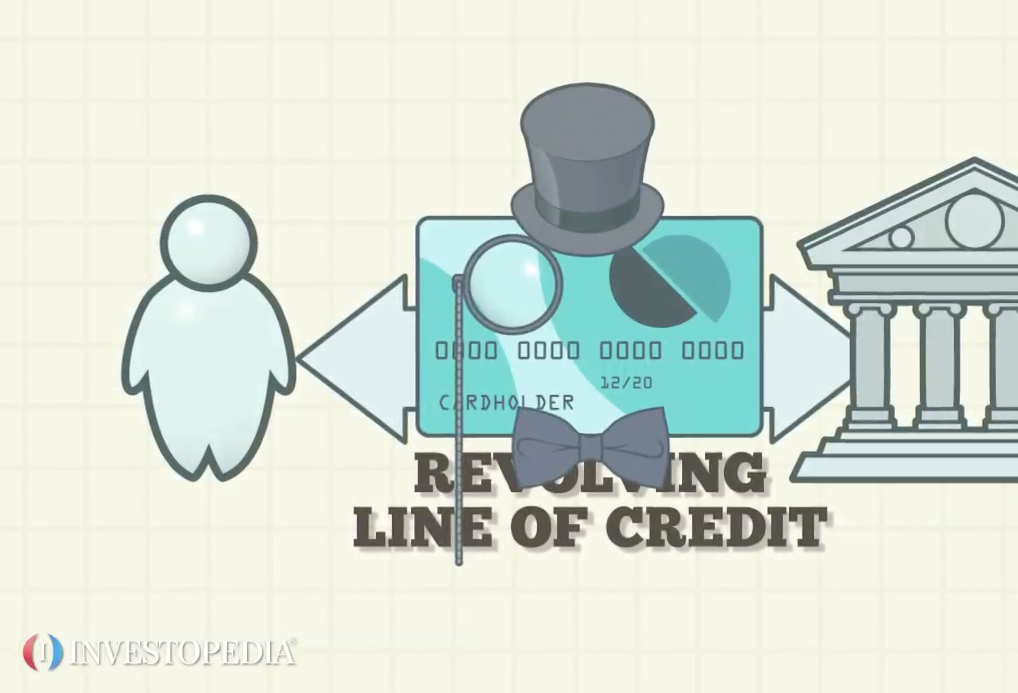

- Line of Credit: A line of credit is an unsecured credit type which is often issued by financial institutions. These lines of credit can be secured if the customer has a viable collateral to use against it. Lines of credit are issued up to a certain amount often determined by the customer’s credit limit, beyond which the loan my not be issued. Like all unsecured loans, Lines of Credit have a rather steep interest rate and need to have a good credit score for avail it in the first place.

Unsecured credit is fairly simple and easy to acquire on a small scale than any secured form of credit. They can be paid off without much external pressure and can be borrowed from friends and family if one so desires. On a larger scale however, this is an entirely different story. It is difficult to lend huge amounts of capital without any form of assurance. That is why venture capitalists ask for such exorbitant returns on their finances to the entrepreneur. Similarly financial institutions ask for some form of collateral (Assets namely) before they issue money to the borrower.

In the end however, it all falls down to the requirements of the businesses and the business owner/Entrepreneur to decide which form of credit (secured or unsecured) is in his best interest. A consultant CFO can be hired for suggestions in this regard.