How to Trade Ethereum (ETH) Futures on BTCC

Launched in 2015, Ethereum (ETH) is a blockchain-based platform that supports the second-largest cryptocurrency by market capitalization after Bitcoin. The aim of Ethereum is to increase and expand more use cases via blockchain technology other than a transaction.

Unlike Bitcoin, which is created to disrupt the financial industry and transform the way we make transactions. The purpose of creating Ethereum is to remove third-party via smart contracts across many different industries. Ethereum 2.0 is expected to go live in 2021, which is a network upgrade that turns from Proof-of-Work to Proof-of-Stake. The upgrade will improve the scalability of the network, and is expected to fasten the adoption of Ethereum based networks for enterprises, which result in a potential increase in ETH price.

On 8 February 2021. The world’s largest derivatives exchange, CME Group launched Ether futures on its platform. The launch is considered to be significant in the industry, where new institutional players who have no access to the spot market can now get in touch with Ether via derivative futures. Investors from the U.S. now can trade regulated Ether futures and be able to receive U.S. dollars when the futures contract expired.

Apart from CME Group, many exchanges have launched Ether futures earlier. For example, the world’s longest-running cryptocurrency exchange, BTCC offers Ethereum futures to its customers in early 2019. In 2020, BTCC announced its daily contract go live which supports two major cryptocurrencies such as Bitcoin and Ethereum, and the daily contract offers 150x leverage. BTCC specializes in crypto derivatives trading and has a diverse derivative product that suits the needs of different traders.

As the cryptocurrency industry becomes more matured and developed. Investors are looking to enter the market with a more sophisticated investment product. One of them is a futures contract. As the promise of Ethereum 2.0 becomes more clear to the market participants, it is expected that the ether futures market will see a boom. It is important for investors looking to invest in Ethereum to fully understand the Ethereum futures contract.

What are Ethereum Futures?

Futures is defined as the legal agreement to buy or sell a security at a specified time and predetermined price in the future. Traders can buy or sell the contract based on the prediction of whether the future value of its underlying asset rises or falls. The futures contract is settled in cash, and there is no actual Ethereum involved.

Ethereum futures are created to meet the needs of traders who are looking for a more efficient way to trade Ethereum. With futures contracts, traders can benefit from the rise and fall of the price movement of Ethereum with various leverage levels. For example, BTCC offers leverage levels ranging from 10x, 20x, 50x, 100x, and up to 150x.

You May Like: Bitcoin Leverage & Margin Trading: How to Do It Right in 2021

BTCC provides daily contracts, weekly contracts, and perpetual contracts for Ethereum futures trading. While a perpetual contract has no expiry date, the daily contract and weekly contract expire daily and weekly respectively. Traders can choose the appropriate futures contract type that suits their needs.

Advantages of Ethereum Futures Trading Over Spot Trading

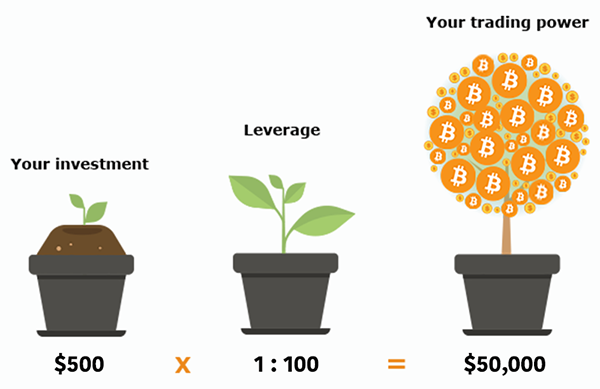

Leverage is one of the major features of futures trading, it allows investors to get the maximum exposure to Ethereum’s price volatility with a relatively small amount of deposit, known as margin.

For example, when the price of Ethereum is trading at $5,000, David feels optimistic and buys $30,000 worth of ETH. David is right about his prediction and the price of ETH rose to $6,000 one day later. As a result, David earned $6,000. Tom also feels optimistic about the price of ETH. However, Tom only has 2,000 USDT in his account, and he decided to use $1,500 USDT as his margin deposit with 20:1 leverage for a $30,000 worth of Bitcoin trade. Both Tom and David can earn $6,000.

The power of leverage can amplify the gain of potential investments with small capital. To maintain the margin position, traders need to keep the margin level to a certain price level from a margin call. It is important to bear in mind that margin level isn’t static, rather it is fluctuating continuously depending on the price of the asset being traded.

A Step-by-Step Guide on How to Trade Ethereum Futures on BTCC

Step 1

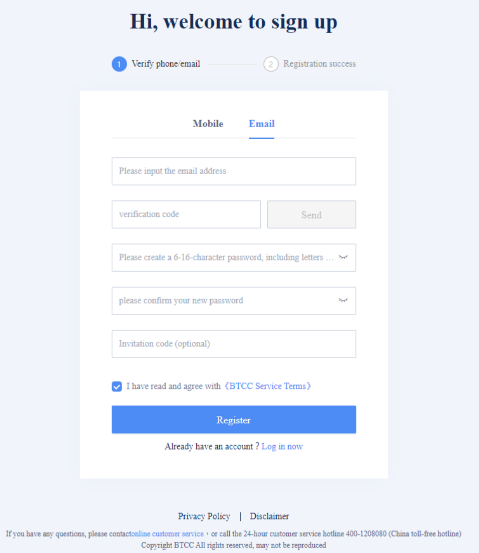

To start your Ethereum futures trading at BTCC, you need to first register an account and complete KYC first. You can sign up with your phone or email address

Step 2

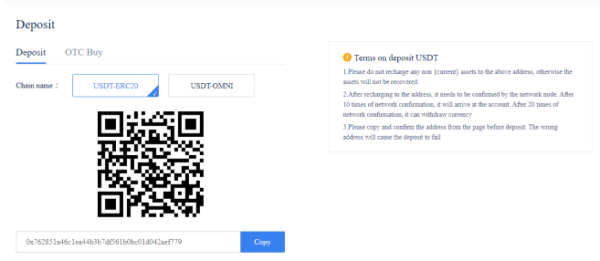

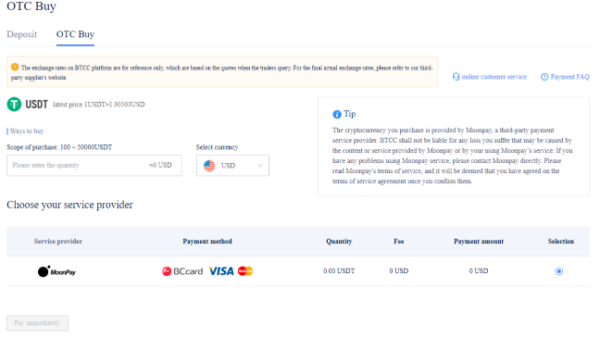

After you complete the first step, you need to deposit USDT to start futures trading. You can deposit USDT at BTCC via USDT-ERC20 or USDT-OMNI. If you don’t have USDT, you can buy USDT with your credit card, BTCC support credit card payment method including BCcard, Visa, and Mastercard. After you have purchase USDT, you can buy ETH with USDT

Step 3

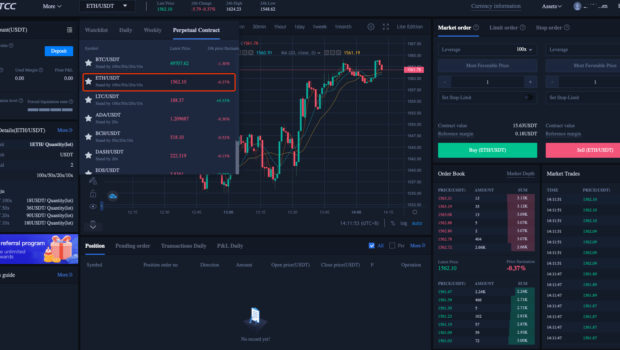

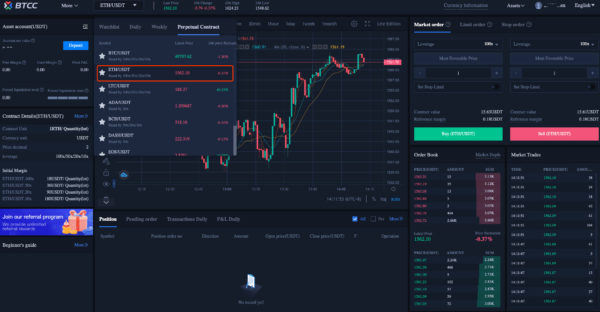

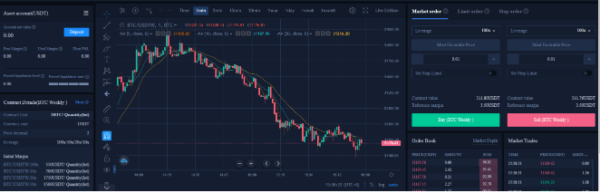

After you have successfully deposited your USDT, go to the trading screen, and you can start the Ethereum futures trading by selecting your leverage level, a number of lots, and long or short options.

For newbies, you can download the BTCC app from the Google Play Store or App Store to try out the Demo account with virtual currency.

New users who make the first deposit can claim up to 2,000 USDT deposit trading bonus. Click here to learn more detail.

Launched in 2011, BTCC has over 10 years of operating history in the space and has never experienced any security incident. The exchange offers 9 major cryptocurrencies, and 16 trading pairs included BTC/USDT, ETH/USDT, LTC/USDT, BCH/USDT, EOS/USDT, XRP/USDT, XLM/USDT, ADA/USDT, and DASH/USDT.

BTCC official website: https://www.btcc.com

In addition to the English market, BTCC is also available in Korean (비트코인 선물거래), Japanese (ビットコイン先物契約), and Vietnamese (Hợp đồng tương lai Bitcoin).