Take Your Real Estate Agency To The Next Level By Partnering With These Financing Options

The real estate industry is not an easy business, neither for the buyer nor the seller. If you are on the opposite spectrum of being an agent, there are certain ways you can ensure growth in the industry. It is best to secure the capital you might need to grow when you first start the real estate business. Irrespective of your financial situation, there are a wide variety of ways to help new entrepreneurs bear the weight of the start-up costs.

Some of the common ones are further listed below:

1. Take Help From The Hard Money Lender

This is one of the most commonly used financing tactics by real estate investors; instead of loans from a bank, with hard money lenders, the investor’s loan from private individuals or groups.

This way, the loans do not have to clear corporate procedures and have looser qualifying requirements. This further ensures that the loan is secured more quickly when compared to conventional ways. More so, private lenders are often more open to offering money to risky projects like Midwood Condo balance units that institutional banks would otherwise reject.

The only catch here is that hard loans often have a significantly higher interest rate than conventional loans. It also requires higher personal collateral or down payments with a considerably shorter-term ranging from a year to two at most. As an investor, you should be confident to pay back the sum borrowed before agreeing to the conditions.

2. Microloans Are Immensely Helpful

New businesses or start-ups that require a great deal of capital to enhance further growth are usually geared to Microloans. As is clear by the name, these are loans of small sums than what is offered in traditional bank financing.

Lower balances indicate that the loans are easier to clear and do not fret about qualifying requirements like a credit score. This is the best kind of loan for people who are worried about borrowing money above their means.

Nevertheless, microloans are not for everyone. Although these loans can go up to $50,000, the average rate of loaning is a quarter of that. Their interest rates are also considerably higher than those of conventional banks, consequently making it important for the borrower to gauge overhead costs.

3. What About Real Estate Crowdfunding

In the early years, investing in real estate was limited to people with immense resources or financial wealth. After the JOBS Act was passed in 2012, crowdfunding has become a common way for investors to expand their portfolios at a significantly lesser cost.

This has allowed investors to browse investment projects already in motion from crowdfunding platforms instead of having to search out and restore properties on their own. For instance, you can now attract more clients by water treatment financing than was ever possible.

Once they have invested, they can then finance shares of the property at a cheaper rate and collect the profits or rent payments after the project has been completed.

That being said, these kinds of investments often come with a higher risk. Investors have much lesser control over the outcome than they could with a traditional fix-and-flip. Along with that, you have to wait much longer for the return on investment, primarily depending on how the deal is structured. If the project fails, instead of the builder, the investor has to shoulder the loss.

4. Do Not Forget SBA Loans

SBA loans, short for Small Business Association loans, are granted to new entrepreneurs, while the association takes the responsibility of paying back the loan to the bank for the meanwhile.

Since these associations are reputed in the industry and have been there for a while, banks are usually more lenient and ready to take up risky investments. While the loans have high borrowing limits, it mainly depends on each investor’s unique situation.

This is appropriate for any new entrepreneur since it comes with lower down payments and longer repayment terms. It also offers protection against balloon payments, which further assures a business to maintain a steady cash flow.

It is important to know that while SBA loans can be used to start a real estate business, like a brokerage or property management fund, it cannot be used to invest in real estate. So, opting for plumber financing for contractors will be perfect.

Additionally, it is subject to high fees, and investors only qualify if they have a high credit score and can show a significant profit in their tax returns. The application process is also very lengthy and requires the loaner to give up personal assets as collateral.

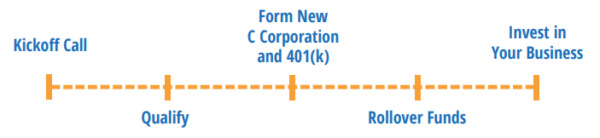

5. ROBS Is An Excellent Option

As a business, popularly known as ROBS, Rollover is the best bet if you think taking a loan is not your cup of tea. In this method, small business owners can ask for funds from existing retired accounts. The advantage of this form of financing is that you do not have to incur any taxes or withdrawal penalties.

Since the money is theirs, there aren’t any debt payments, leaving the full amount free to invest in business growth. If a business fails, no bad impression is left on their credit score or assets as well.

One must always weigh the risks before opting for a ROBS strategy. On the one hand, the borrower can draw the money directly to their account; this means that their available balance might be lower than the loan. If the investor decides to put their whole retirement fund into a business and fails, they might be left without any security in retirement. Much like SBA loans, ROBS can also not be used to invest in property.

The Bottom Line

These are some of the most common ways to fund your real estate business and take it to the top. Each of these financing options comes with its set of advantages and disadvantages.

So, before finalizing your decision, make sure to do thorough research on them. Go through their reviews, understand both the pros and cons. Compare each option with one another to realize which option will be more fruitful for your real estate agency.

You have opened the real estate firm with a long-term plan, right? So, it would be best if you think about it 5 years from now to get a proper idea of how things will turn out in the future.