What are the Benefits of Using a Holding Company?

Using a holding company comes with a slew of benefits in both the tax and day-to-day financial world. Holding companies can be limited liability companies, limited liability partnerships, and parent companies.

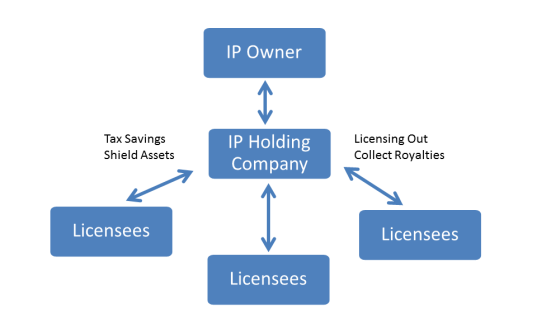

Many business owners prefer to use holding companies as a form of wealth management because though a holding company may own part of the assets, they do not participate in day to day decisions and interactions within the business. Typically, the number one purpose of using a holding company is to oversee a group of entities or storefronts.

Are you interested in working with a holding company? Here are a few more benefits that come alongside using a holding company.

You can defer and save on your tax bills

As a holding company is typically overseeing a variety of entities, they have the option of filing as a singular tax entity. This can be especially advantageous for business owners with multiple ventures, as they can offset the gains of one entity with the losses of another and reduce their overall tax bill.

This means that if your holding company is managing assets properly, you can use the money saved to invest in other ventures or developments for other subsidiaries resting underneath the parent company. Some may even opt to choose a holding company in another country to ‘choose’ which tax laws will apply to them.

You can use tools like Sayari to look up popular Chinese holding companies. Here’s an example using JPS Holding Group corporate records. You can get an overhead view on their specialties, view litigation and financial records, and ultimately make a better decision on an offshore holding company.

You can broaden your skill set

Another benefit to using a holding company is the skills that come alongside the various other entities within the holding company. For many, this means they expand their services and their sales reach on a national and international level.

More importantly, they can expand their acquisition net by leveraging the combined financial strength of the holding company to enter bigger, better, and more profitable projects and business deals.

You can manage your risk better

Big business can get messy fast. By using a holding company, you can mitigate and absolve yourself of various financial risks:

- Patent licensing. As holding company are able to file patents, you can file on a large scale to mitigate technology to various entities within the holding company.

- Financial health. Reporting is a must and a holding company will certainly be helping you do a lot of it. When you work with a holding company you are able to unlock the benefits of a bigger, stronger entity. More importantly: The constant communication will help you see your financial health from a bird’s eye view and get an accurate image of where you sit in the market.

- Big decisions. The benefit of adding a holding company is the benefit of the shared skills (as mentioned above). With this comes the ability to weigh financial decisions with more certainty. Ultimately, this means better decisions and better numbers.

Conclusion: If you need to centralize, holding companies are the way to do it

A holding company isn’t the best decision for everyone. However, for those who are entering the global market or have multiple business entities operating within the same industry: Holding companies can help you grow, manage risk, and save on your tax bill. The best fit for holding companies are owners who own 50% or more of the stock within their entities and would like to globalize, centralize, or unify their various businesses under one corporate roof.

Do you use a holding company? Why or why not? Share your opinion in the comments.