Mobile Apps & The Way They Can Give Your Business a Huge Boost

Mobile apps have resulted in a big increase in businesses across several industries. Whether it is a media & entertainment, banking or tourism industry, the use of mobile apps has resulted in the positive increment of users as well as more business.

Let’s start with the use of mobile apps in the Tourism industry!

Mobile apps in the Tourism Industry

Just to reach potential customers and new markets, travel agencies are continuously in practice to ensure innovative travel services to the industry.

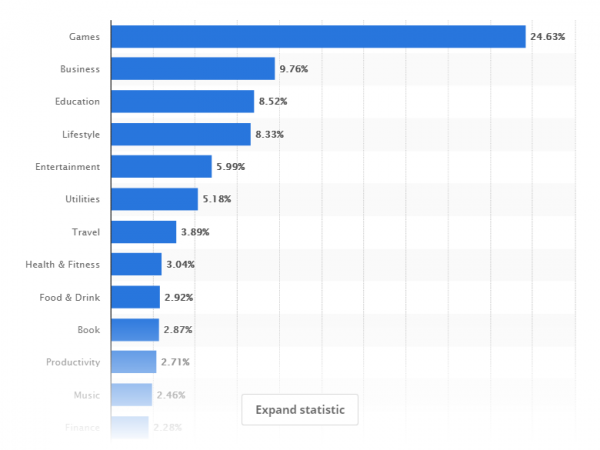

According to statista, this is a statistic that shows various app store categories and their percentage.

The more interesting thing is that travel booking with the help of mobile apps have grown 1700% and this growth was seen over a time period of 2011- 2015. Moreover, it has been seen that the tourism industry has experienced an entire overhaul in recent years.

5 ways in which Mobile apps have revolutionized the Tourism Industry

Apps have become new sales channels

A mobile app for your travel business has the ability to create more chances to collaborate with airlines and hotel chains. In this way, it helps you to make extra money as a commission.

For instance, you can easily create a travel app and your customers can use it to book hotel rooms and air tickets.

In case an airlines want to promote the offers through the mobile app, you can collaborate with that airline and broadcast the discount code with the help of push notifications. Whenever a user books a ticket using the same discount code, it helps you to earn a piece of revenue.

A powerful tool to attract customers

In the present time, online promotion is a must if you want to increase the reach and visibility of your travel business. Marketing has an important role in any business. And using mobile apps is one of the best ways to market a business.

Having a mobile app for your travel business can help you reach customers from all over the world. Moreover, you can stay connected with these customers round the clock. Promotion is necessary to make a business survive in today’s competitive world.

A mobile app is the best medium to stay connected with the customers from research to booking their trip etc.

Apps offer a simple booking procedure

With the help of a travel app, users can simply book their favorite hotels through just a few clicks on their smartphones. This level of simplicity can grow your travel business to new heights.

For example, customers can easily book tickets for their next destination, book sightseeing and make hotel reservations at pocket-friendly prices.

In case you use machine learning and AI in your app, it can be a more efficient app. This app can learn from users’ past behavior and can offer more custom made offers.

Apps enhance overall customer experience

It is quite helpful to get a glimpse of the place you plan to visit. And this is possible with the help of a travel app. Using a travel app, travelers can see the real-life images of travel destinations.

Or with the help of the app, users can write a review for a place they visited last or they can read reviews of a place they are planning to visit.

In simple words, we can say that apps can increase awareness about places travelers especially visit such as best cafes, hotels, and sightseeing venues at any given place.

Apps vanish the paperwork

Since the inception of mobile technology, nearly every industry has become paperless. The travel industry is not much different. Mobile apps can help in reducing paperwork in the travel business just by safely storing all the important documents in one place.

Furthermore, today’s travelers also prefer having a soft copy of all their bookings. Hence, in your travel app, you can eliminate the need to carry original documents for your customers.

Mobile apps in the Banking Industry

Banking is becoming a more and more technology-savvy industry largely because of mobile technologies. According to a survey done by statista, the number of smartphone users is increasing linearly and is predicted to pass about 3 billion by the year 2020.

The number of people using banking apps is also progressing. Hence, here are some factors that determine the need for investing in a mobile app.

Advantages of creating a mobile banking app

Mobile banking is good for customers as it offers convenience, security, and ease of access. Moreover, mobile banking presents several distinct benefits to the banking industry.

Mobile banking lowers the bank’s expenses

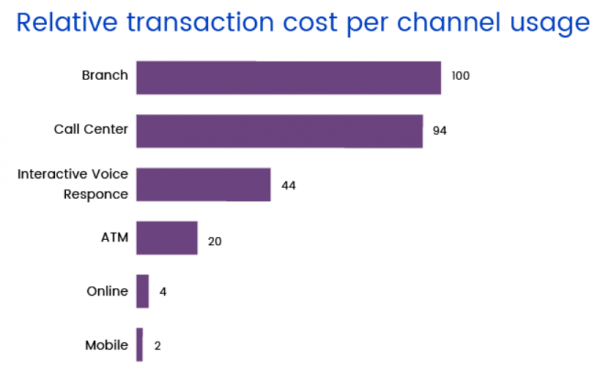

Mobile transactions enhance a bank’s overall efficiency with the help of:

- Saving money on printing and delivery

- Eliminating the need to hire additional workers

- Saving the operational costs of running bank branches

- Providing transactions that are quite cheaper than ATM transactions

- Helping banks go paperless and be environmentally friendly

According to research performed by Deloitte, the price of mobile transactions in the future may slow down to 50 times slower than branch transactions and 10 times slower than the normal ATM transactions.

Hence, this offers a chance to lower operating costs and enhance efficiency.

Considerable Return on Investment

According to a study performed by Fiserv, mobile banking puts a large impact on customer engagement and returns on investment in various ways. With increasing mobile banking rates, the average institute can create millions in additional revenue.

Engaged mobile banking customers use more of the services

As compared with the branch’s only customers, mobile banking customers hold more products from their financial institutions. The reason behind this is that mobile banking customers are more engaged with their companies and services.

Mobile customers complete transactions more frequently

Research shown by the ABA banking journal suggests that instant access to a user’s financial information can affect additional transactions. This is the reason that several users of mobile banking services create more average revenue than users of non-mobile banking services.

Banks create 66 % more revenue from users of mobile banking services from branch only customers.

Enhanced Customer Experience

A mobile banking app can help enhance the customer experience in many ways:

- Round cloud availability. With mobile banking, customers are not restricted by working hours and the locations of branches or ATMs. And by offering round the clock services, customers can easily access their accounts whenever they require.

- Instant fulfillment of customer requirements. People appreciate mobile banking because it puts all the services at their fingertips. Instant gratification makes customers satisfied.

- Entire control over customer finances. Mobile banking helps customers to keep all the finances under control.

Good Security

Security is one of the most important issues faced by customers. Online as well as mobile banking both come with various security risks.

Just to enhance security, banks use security solutions such as gesture patterns and biometric data like fingerprints and retina scans in addition to conventional passwords and two-factor authentication.

Almost all financial entities use encryption to protect financial information and privacy that guarantees hassle-free mobile banking. Since the proliferation of platforms is there, chances of errors become less.

Collecting customer analytics

With the help of a mobile app, you can collect and analyze actionable metrics. It permits you to measure and enhance the services and customer experiences.

Such kind of metrics help banks in understanding how users interact with an app and why. All the metrics can be divided into three major groups – user engagement, acquisition and performance.

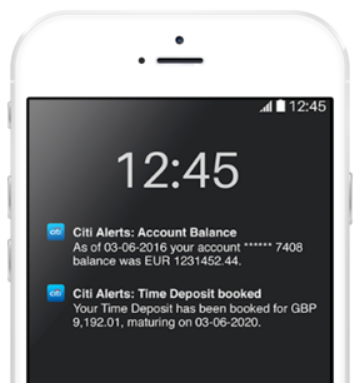

Retaining users with the help of push and in app notifications

Push and in app notifications provide several benefits to you and your customers. They help in making customers aware of all significant offers and discounts. Moreover, these notifications can help customers know about enhanced credit limits and rates.

Banks those who already implemented this option have a good competitive benefit over other financial institutions.

Capability of using Artificial Intelligence

Artificial intelligence means intelligent actions of devices and applications without any human intervention. AI includes machine learning, natural language processing, algorithms, chatbots and machine analytics.

The biggest promises of AI for banking are efficiency, speed and security. It is quite interesting that 32% of financial institutions have already adapted AI while 62% are planning to do so in 2018.

Chatbots

With the help of chatbots, banks save more money. Moreover, chatbots are quite simple to use for less technical savvy customers. For instance, Bank of America has introduced Erica chatbot that helps clients in making smarter decisions.

Customers of Bank of America can get help with the help of voice recognition and text messages. Erica sends personalized recommendations, promotions, and offers.

Conclusion

I hope now you have enough knowledge about the benefits of mobile apps in tourism and banking industry. In case you are willing to create mobile apps for your own startup or small business, then you can contact various mobile app development companies present in the market and give your business a huge boost.