The Future of Banking and Technology

As technology innovates onward, so too does the world of banking. Now, both sectors have begun to merge together in a perfect blend of ease and convenience. This has largely resulted in the portmanteau ‘Fintech’, a combination that helps those with banking enquiries like never before. Moreover, its popularity is growing too, alongside other developments being made elsewhere.

But are technology and banking a good mix? Do they work well in conjunction with one another? Are there any safeguards? Well, the answers to these questions are now available. The future is now!

Consequently, here’s some insight on the future of banking and technology.

Accessibility to Banks

It used to be that banks were a struggle. Customers would face queues at every turn, have to navigate through busy traffic and crowded high streets, and deal with a never-ending torrent of minor inconveniences. It may not seem like too big a deal, but technology has gone a long way to eliminate significant amounts of this hassle.

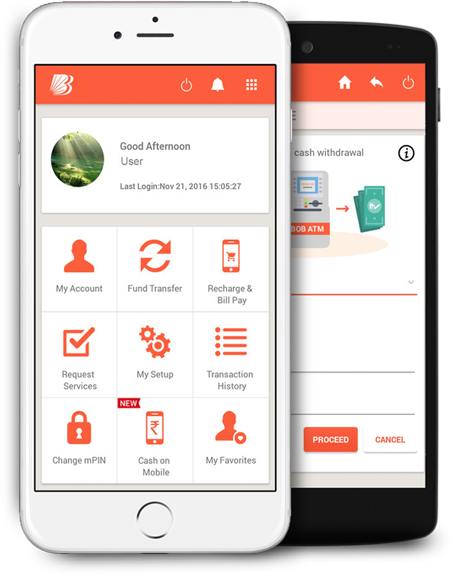

Everyone’s got a computer, and these days anyone’s queries and concerns can be answered with a quick google search. Struggling to find a loan? Well, in no time at all people can utilise the services of companies like Likely Loans, getting the help they need at the click of a button. It’s convenient to the point that even people who would never enter a bank unless necessary can now access their financial information online. Just input a username, password, and you’re in on any device albeit a computer or smartphone.

Educating Customers

Unfortunately, some people out there are lazy and apathetic. Moreover, there’re other people who just find it inherently difficult to understand the swirling complexities of banking. The larger point here is that, in some circles, there’re many people who don’t know how to manage their money and keep it safe, and it’s a very real shame indeed.

In the future, there’ll be more AI algorithms solving customer queries at every turn. Further apps will be developed to keep customers connected to and informed on their personal finances. Each problem will have an instantaneous solution presented via digital means. It makes customer-bank relations far more watertight, even if there’s just a chatbot on a webpage. Ultimately, the informative aspect of banking will be more available and digestible.

Workplace Efficiency

Of course, banking isn’t just about the customer – it’s about the internal workforce too. By utilising cloud-based technologies, processes are streamlined, and productivity is significantly bolstered at every branch that utilises the latest devices. Those behind the banking curtain can perform better, and generally carry out their jobs with greater efficiency.

In many respects, a bank is a business like any other with many of the same concerns. Customer information, employee data, branch performance metrics; they’re all accessible on cloud-based storage services. This allows banks to keep up with an ever-evolving business world and minimise the chances of things like misplaced paper documents. Ultimately, banks will be able to keep up with an increasingly demanding world as they implement the latest tech.