3 Tips to Help Find the Best Online Money Management App

Over the past decade, banking has largely been transformed. And this is mostly down to the rise in online money management services.

Last year, the Office for National Statistics reported that 69 per cent of Brits bank via the internet. That figure has nearly doubled from the amount recorded 10 years ago.

And it doesn’t stop there, mobile apps have made money management even easier to achieve.

But how can we identify the best money management apps? Here are some tips for you to find the perfect one.

1. Budgeting

Ideally, a money management app should live up to its promise. But often, users can still overspend with their phones.

In fact, a recent survey released by Bain & Co. revealed that mobile bankers are twice as likely to spend excessively than people who rely on more traditional methods.

So, an app that gives budgeting support could provide a solution to this. Consider the money-saving tactics that work best for you, whether it’s mobile reminders or calendar updates.

If you locate an app that supplies these functions, you could bank and manage your finances at the same time, with complete ease.

2. Safety

When it comes to the internet, safety is key. This is especially true if you want to upload personal information to an online account.

Statistics released in 2017 by The Education Policy Institute highlighted that over a third of 15-year olds in the UK use the internet heavily. Since then, this figure has most likely increased.

Findings like this have encouraged more banks and financial organisations to guarantee security in all their services. This extends to money management apps, too.

So, ensure you look for a recognised institution that proves it can protect your financial details. It could prevent any data problems from occurring in the future.

3. Features

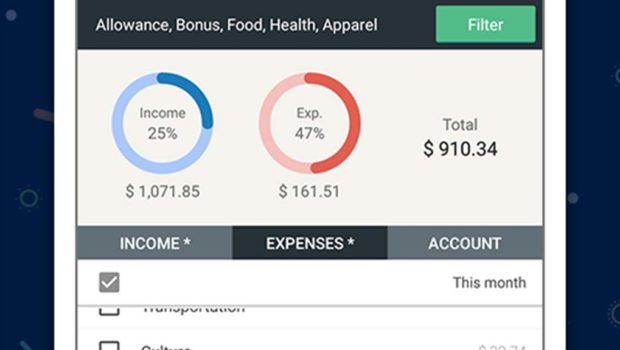

With so many money management apps on the market, it is worth considering what features are most important to you.

Some helpful features that some apps provide include colour-coding and banking phrase explanations. These functions enable lots of app users to better manage their finances, including those with specific learning differences, such as ADHD, Dyslexia and Dyspraxia.

If this level of support appeals to you, it may be worth finding an app that specialises in all-inclusive banking.

Other apps feature saving tools to help you hit your financial goals and even evolving graphs to help you track monthly financial progress.

Mobile financial services deliver immediate results for individuals wanting to spend and save money wisely. It’s unsurprising, therefore, that so many people are choosing to bank this way. Now you know what to look for, you can ensure that you make the most of this opportunity.