Tips to Organize Your Monthly Spending

Handling your monthly budget and balancing earnings and spending is a very important task in any household. Very often ends up being stressful and inefficient. Well, that is about to change. We have compiled a list of tips and tricks to better manage monthly spending, and today we are unveiling it to our readers.

Taken from Pixabay.com

Free for Commercial Use & No Attribution Required

Total Your Earnings and Spending

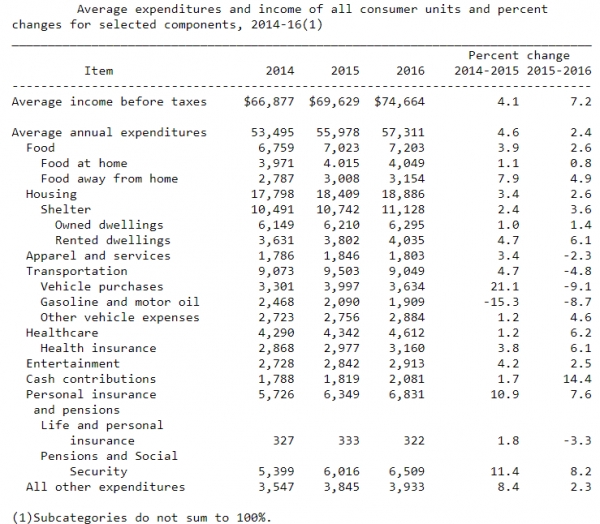

Did you know two-thirds of Americans wouldn’t be able to allocate $1,000 for an emergency? This was the result of a poll conducted by the National Opinion Research Center of the University of Chicago in 2016. This means 7 in 10 Americans have less than $1,000 in their savings. This is due to 2 factors: expenditure increase and mismanagement of earnings and spending. The first step to managing your expenditures / income is to look at your spending this way:

The Nonvolatile Spending

First, you have the “nonvolatile” category, these are your fixed cost expenditures such as housing, personal insurance, healthcare (depends on what your insurance covers) and transportation. Basically comes down to rent, health and car insurance, and of course the average fuel you require per month. When organizing your monthly spending these are costs you can “count on”; in a normal situation they will not vary. If you earn X salary you must always allocate a % of the income to those particular items.

Important – When picking an insurance or even Los Angeles Car title loans, find one which is best adequate to your current financial status. Ask for a quote, don’t rush your decision, plan through and don’t commit to anything you won’t be able to pay or repay eventually. Be conscious of your finances and fixed spending and earning.

The Volatile Spending

Now it gets tricky. The “volatile” category, these are the expenditures in which you have more control on and the ones between the line of spending too much money and saving money. It requires self-control, organization (planning) and budget allocation. Under this category we have: food, apparel and services, entertainment and cash contributions.

#1 Rule– Food must be a nonvolatile spending. In other words, you must determine your budget and go buy essentials at the beginning of each month. Salt, milk, water, frozen meats & fish, all the items that don’t require to be ‘fresh’ (e.g. vegetables and fruit) or expire quickly, must be shopped 1 time per month in a planned way. The old classic of writing down the name of a product every time you run out of it. Or, take advantage of technology and download a grocery shopping list app and keep track of what products you need to buy next. By doing this you avoid losing control of how much money you spend on your shopping runs. You will always have the basics at home and only have to worry now and then about bread, vegetables and fruit.

#2 Rule – Establish how many times per month your income allows you to attend your favorite social events. Yes, we are aware it doesn’t sound fun planning beforehand how much you are allowed to spending on leisure activities and entertainment. However, it’s very important. This is where we tend to have less self-control and lose all our focus. Set a personal rule, don’t spend more than 7~9% of your after-taxes income on leisure activities and events (e.g. cinema and concerts). This will help you limit your spending and stop going over your budget. Keep track of how much you spent that month.

#3 Rule – Be smart about your cash contributions. Most people may not be aware of it, but cash contributions have been increasing at a fast pace, driven mostly by a recovering economy. These include: care of students away from home, contributions to religious, educational, charitable, or political organizations, etc. You must manage your contributions wisely, time them, pick a date and stick to it.

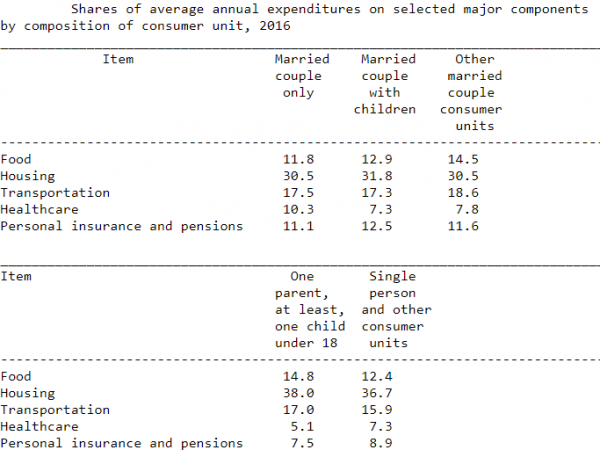

Taken from CONSUMER EXPENDITURES–2016 – Bureau of Labor Statistics of the United States

Budget Allocation – Do It Smart

Even after defining your priorities and limiting your spending, you still need to allocate X% of your income according to the particularities of your personal and financial life. Most bloggers and authors advise you to stick to a 70/20/10 or 50/30/20 rule. Thus, allocating your monthly take-home income for 70% monthly expenses, 20% savings and 10% into investments/retirement. Although you are not forced to follow their recommended values, you should definitely take into consideration the principle: don’t spend your entire income.

If your monthly spending isn’t organized in a way to allow you put some money on the side, then it’s a faulty plan. Why? Because emergencies occur, and as I mentioned previously, 7 in 10 American aren’t prepared to deal with a $1,000 emergency. If this occurs and you haven’t setup your financial organization properly, it will jeopardize your entire planning. From there on it may snowball into harder to manage situations. Therefore, always allocate budget for your savings.

Put at least 10% of your after-tax income into savings. Don’t have enough? Cut on “volatile” spending such as entertainment and apparel and services. The future-you will be thankful.

Keep Track of your Financial Data

Everything we have discussed so far, total earnings and spending, budget allocation and priorities must be accounted for. Save your receipts, write in a notepad every time you overspend, be aware of payment dates so you are not hit with an unexpected penalty. Let it become part of your daily routine, write down information and check on it on a regular basis.

Taken from pexels.com

Free for personal and commercial use

No attribution required

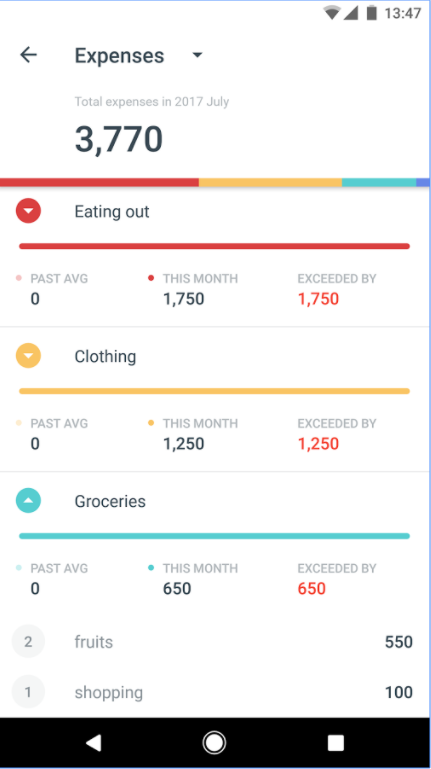

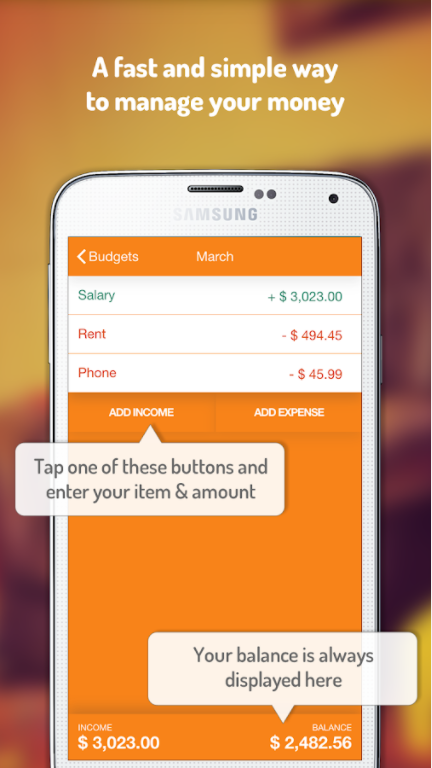

A Few Tools to Help You Track Your Spending

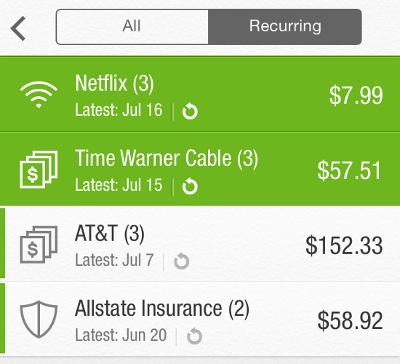

Taking notes and saving receipts piles up to a huge stack of sheets? Yes, we know, it’s annoying and stressful. That’s why we must take advantages of the modern day technologies and make it work for our benefit. Here are a couple of free phone apps you can use:

- BillGuard – For iOS. Keep track of you spending by type, month and location.

Taken from pcmag.com

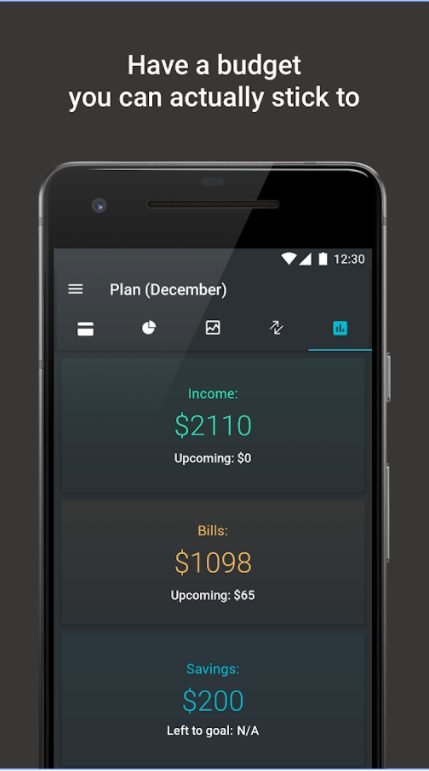

- PocketGuard – For Android. Keep record of all your transactions, compare your spending habits month by month, create spending limits and much more.

Taken from Google Play Store

- Dollarbird – For iOS and Android. Add past and future income and expenditure and calculate the impact on your wallet.

Taken from Google Play Store

- Fudget – Available for iOS and Android. Track short-term budgets (e.g. holidays and partner’s anniversary present).

Taken from Google Play Store

Rework your Budget

You will have to adapt your budget and spending habits according to a wide variety of factors in your life, the same way your income might change due to a job promotion or even changing jobs, your social life will also change many times throughout your life. The key is to: prepare and adapt. Check the table below and see how things differ from household to household.

Taken from CONSUMER EXPENDITURES–2016 – Bureau of Labor Statistics of the United States

You won’t figure it out in the first try. It’s important to keep this in mind. You will have to test and adapt your budget many times before you find the one which best fits your way of life. Do not expect to go from 0 organization and efficiency to 100% success. Reality is we all struggle with our finances from time to time, it will happen. However, if you prepare ahead of time and stick to the plan you will have all the bases covered for any particular eventuality.

If Needed Find an Accountant

If you are having a hard time managing your income and expenses and you can afford specialized help, don’t be afraid to look for an accountant. In most cases this won’t be needed, but if you are dealing with many sources of income and a wide range of expenses, look for a local accountant and put your financial life on the right track.

Share Your Tips with Us!

Now it’s your turn! Any tips missing on our list? Have you found an efficient way or organizing your monthly spending? Let us know! Have any questions or doubts? Leave a comment below and we or an informed reader will gladly help you. Personal finance is a very important issue, it plays a big role in our life and we must tackle it before it tackles us. Have a great day!