What Advisors Should Look For In Portfolio Management Software

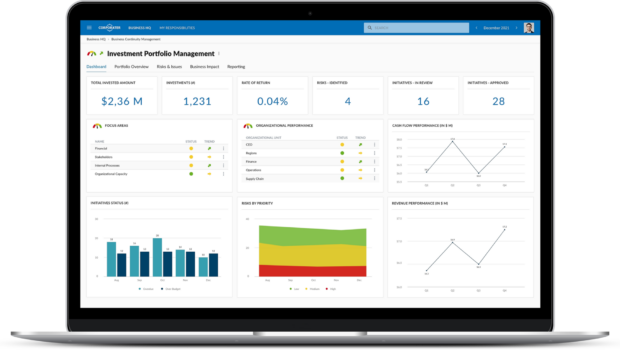

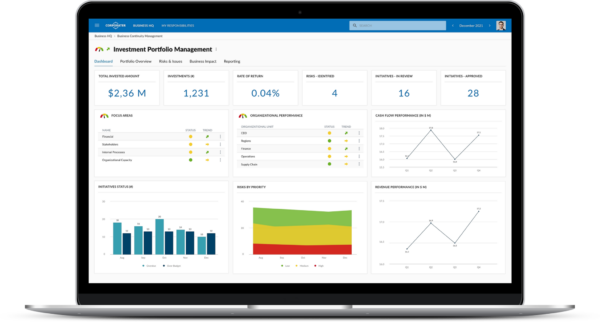

Are you looking for a way to manage your investments and maximize your returns efficiently? Look no further than portfolio management software. Management software for the portfolio is a tool designed for advisor to help them manage their client’s portfolios more effectively and efficiently.

The software allows advisors to organize their portfolios systematically, analyze investments more efficiently, automate trading decisions, and track performance. Simply put, it enables portfolio managers to make more informed and strategic decisions that significantly impact portfolio performance.

By helping advisor stay on top of their clients’ portfolios and create more innovative investments, this software can benefit a variety of investors, including retirement investors, short and long-term investors.

There is an array of available options, so advisors must understand the selection criteria for choosing the right management software. Here are the key steps advisors should consider when evaluating and selecting the software.

Request for Proposal (RFP)

When selecting software, advisors should consider creating a Request for Proposal (RFP). This helps to ensure all criteria needed to evaluate the software are documented and that the software chosen fits the firm’s needs. It should include features the advisor expects access to, pricing models, customer service, technical support, and the platforms and devices one can access the software from.

Software Demo & Trial

Advisors should look into demoing and trial periods when investing in software. This allows the advisor to ensure that they feel comfortable with the software before investing in it and provides an opportunity to try out the different features and tools in the software.

Build Consensus

Once an advisor has narrowed their choices to a handful of potential software, creating consensus in the firm is essential. Advisors should call a meeting with the stakeholders in their firm and discuss the merits of each possible software before concluding.

This ensures everyone in the firm is on the same page and reduces the risk of making the wrong decision.

Final Selection

Once all requirements and consensus are achieved, the firm should make its final selection. After evaluating and demoing the different offerings, the decision should be clear, and the advisor should have the necessary information to make the final selection.

Advantages

1. Increased Efficiency

The most significant advantage of portfolio management software is organizing investments, tracking metrics, and viewing investment portfolios in one place. This makes it much easier for advisors to keep up with their assets and see how their investments perform.

The software can save advisors time by automating specific tasks like data entry, calculations, rebalancing portfolios, and tracking events that can affect the value of their assets.

2. Track Performance Accurately

With this software, investors can receive real-time data to track the performance of their investments and identify trends. Investors can monitor their investments to see if they are meeting their financial goals and if any adjustments need to be made to their current strategy.

The software allows advisors to quickly make changes here and there without needing to manually access each account they are tracking, which can save time and energy.

3. Reduced Risk

Using this software, advisors can also reduce their investment risk by tracking metrics such as return volatility, which can help them make more informed decisions.

The software can track performing investments, identify stagnant ones, and provide recommendations for alternative investments that may be more suitable for the investor’s specific strategy.

Conclusion

Portfolio management software offers many benefits to investors and wealth managers. With the help of this software, investors can easily keep track of their assets and portfolio performance and make smarter decisions with more accurate data.

Furthermore, advisors can ensure everything from a Request for Proposal to the final selection of the software is done correctly and in consensus by following the above steps.