Top 8 Tips For Tax & Regulatory Compliance Services To The Telecom Industry

Before jumping into the pool of the telecommunication industry there are certain things a business owner must understand to smoothly run a startup. It is highly important to eliminate the misconception that the telecom service provider is not viable to pay any tax and regulatory fee and that the job is being done by the main carrier.

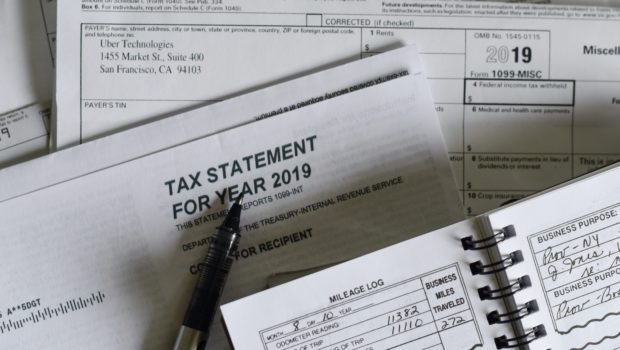

The carrier is responsible to pay the general wholesale tax when they sell the service, whereas you being the reseller is responsible to take care of custom taxes on goods and services, asset development, production, independent contractor tax and other areas. The tax compliance in the telecom industry is diverse and tricky, hence taking help from professionals is highly recommended to prevent mistakes, so sit back, relax, and let the skilled people do the job for you.

It is beneficial to know the kind of taxes and regulations you are complied with. Below are the steps that need to be considered to avoid complications,

- Study the Federal regulatory requirements

Following the orders passed by the FCC (Federal Communication Commission) is of great importance to survive in the communication industry. Before initiating the business study the defined laws strictly.

- Look into state and local regulations

In the process of looking into federal regulatory requirements, many businesses tend to forget about the importance of State and local regulations, whereas they are as important as federal. Make efforts to sieve through the State and local legislation demands for new businesses.

- Application of tax on State and local transactions

The rapid evolution and advancement in the telecom industry have brought significant changes in the taxation process. Different states have varying application of taxes considering audience demand.

- Pattern of invoicing the customers

Customers pay tax to telecom companies at both the federal and state level. There is a certain percentage of both. Invoice the bills according to how the percentage is described and distributed.

- Apply for federal, state, and local regulatory licenses

Having held on all the required licenses both at the federal and state level is very important to run the business without fear. Apply and own all the demanded licenses to enter the telecom industry.

- Register the company with taxing authorities

To launch a telecom business it is vital to register the company with all the authoritative departments which includes taxing authority as well. Seeking help from tax and regulatory compliance service providers will ease the task for you.

- Device a compliance reporting solution

There are numerous professionals available to create, help and implement a compliance reporting system to keep your accounts safe and efficient. The telecom companies must deliver reports as per demand, therefore device the system accordingly.

- Keep track of taxes and fees

The telecom companies must be vigilant to calculate, bill, collect and remit the taxes and other fees to the authorized taxation body.

If you keep the discussed tips into consideration when running a telecom business then there is no way you can go wrong in running it the way it is expected to be run.

Photo by Olga DeLawrence on Unsplash