Payday Loans Checklist: What Lenders Ask to Qualify for a Loan

Payday loans, also known as cash advances or short-term, high-interest loans are loans due on the next payday. It is generally quick and easy to get cash with minimal payday loans checklist or requirements.

What is a Payday Loan?

Aside from cash advance, it is also called check advance loan, post-dated check loan, or deferred deposit loan. Lenders provide borrowers cash that comes with interest and fees and is due on their next paycheck.

How Does it Work?

Lenders ask only a few requirements, including valid identification, attaining at least 18 years of age, an active bank account, and proof of income. You receive the cash within minutes or 24 hours once approved. To check approval for payday loans, check this list of online payday lenders for eligibility.

People with bad credit and have no savings are the ideal target of these payday lenders. The loans come with high-interest rates and fees on a short-term repayment scheme.

You can apply online or personally if they have a physical office in your area. In the United States, different states have different laws governing payday loans. This type of loan is not accessible in some states.

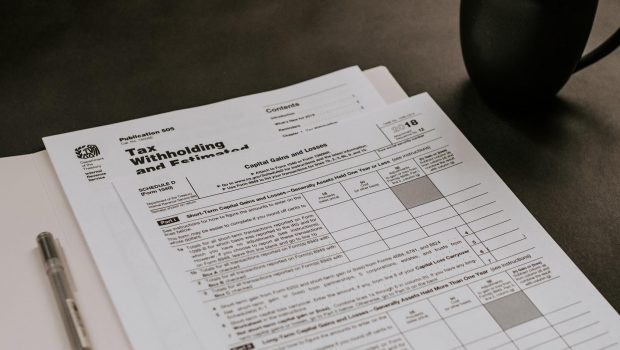

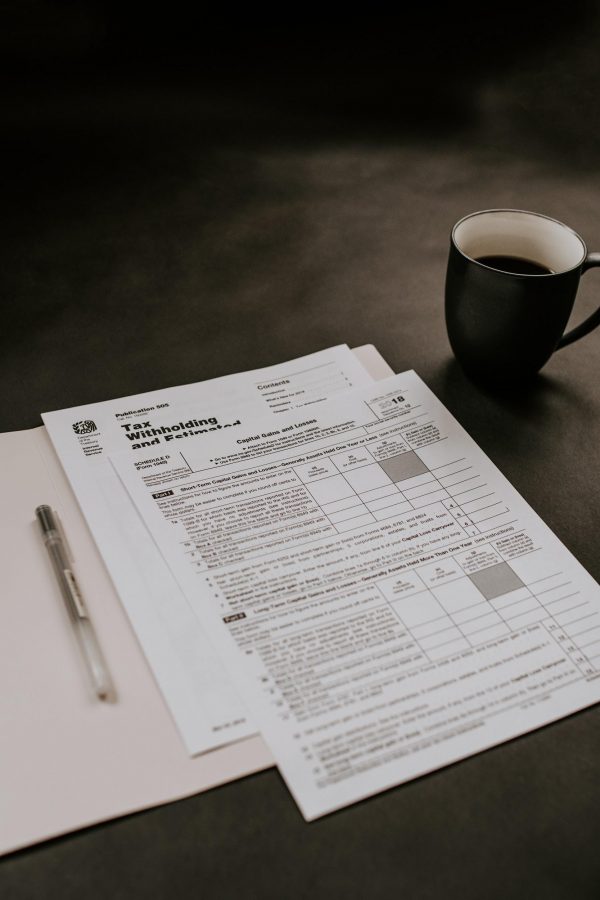

Requirements

The Consumer Financial Protection Bureau or CFPB demands that lenders ask for these requirements to borrowers:

- An active checking account.

- A valid identification.

- Proof of income.

- At least 18 years of age.

Once qualified, lenders can give cash within 15 minutes. Lenders can also ask for a check that amounts to the loan and fee. They wait for the borrower’s next payday before they process the payment.

The borrower can pay the whole amount of the loan, writes a new post-dated check, or allows the lender to cash out the post-dated check. Although getting the loan can be fast and easy, paying it immediately on the next paycheck can be difficult for borrowers.

Loans run from $100 to $1, 000. It earns about 400 percent annual interest (APR). Repayment is usually due after two weeks.

Lenders do not require a credit check. However, charges are computed based on the loan amount. Small loans can have a huge APR.

Oftentimes, borrowers end up not paying the whole amount and extending the loan. The longer the loan is extended, the higher the fees are included in it. If not managed, you can end up on default or getting into the trouble of a debt trap.

Despite this reality, more or less 2.5 million Americans are taking this loan every year, according to The Economist. Cash advances have become a popular resort for them because it is one of the easiest and most lenient option to get instant money.

It was found that 80 percent of borrowers have re-borrowed cash within 30 days. One on five loans have defaulted.

How much do you pay in a Payday Loan?

Generally, the cost of loans depends per state. Fees can be between $10 to $30 for every $100. A typical loan earns charges of $15 per $100 on a two-week repayment scheme.

How to Repay?

Borrowers need to repay the full amount plus the charges on their next paycheck. When getting loans, check your due date with the lender to avoid possible problems.

You can pay through the following method:

- Direct debit in your bank account

- A post-dated check

- A check on your next paycheck

- Online via the lender’s site

Failing to repay on the due date gives the lenders the authority to withdraw the amount from your account. Since many borrowers fail to repay on time, they end up on default.

What is a Rollover?

In some states, a rollover or a renew feature is accessible to borrowers. The loan is automatically renewed if you are unable to pay it in full. The unpaid loan is carried over to the new loan.

It is banned in most states because it causes the borrower to a downward spiral of debts. Instead of a rollover, you must take other options like refusing to rollover your loan.

Lenders may suggest that it’s better to roll over without explaining to you its consequences. If you do, you may incur more interest and charges making it harder for you to pay your loan.

Talk with your lender on how you can repay on terms that are easy for you. Seek a piece of debt-free advice. Rollover of loans two times is now prohibited by the law.