Why Is GST Significantly Better Than VAT?

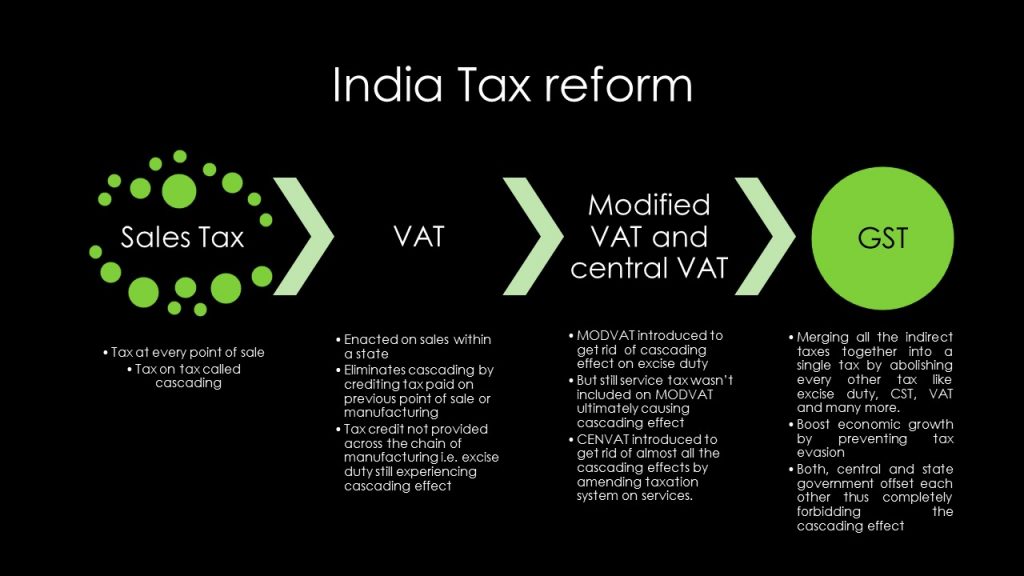

The Government of India changed the face of the taxing structure of the country by introducing Goods And Service Tax in the year 2017. The multiple taxes on goods got done away with. Before this, there were several taxes in the country. The VAT was the most popular and important one amongst them. VAT along with other taxes got replaced with GST.

Before we understand the difference between the two, it is first important to understand what is GST? It is an indirect tax that was passed in the year 2017. The tax is said to be a comprehensive, destination-based tax. It is levied on goods and services. The reason why one needs to understand what is GST is for the sole purpose of understanding the drastic change in the country after the introduction of the same. It is an indirect tax for the entire country.

Now that we have understood what is GST, let us see the significant difference between GST and VAT.

1. Cascading Effect

VAT had a cascading effect. Before GST was implemented, retailers had to pay VAT at every step. From the manufacturer to the selling, retailers had to pay VAT on every step. However, with GST, the retailers can simply transfer the tax through the retail change. This is good for consumers and retailers. Once this is done, retailers feel fewer burdens on themselves.

2. Implementation

The VAT was implemented on goods. On the other hand, GST is implemented on goods as well as on services. Before the GST, different taxes on goods and services were implemented. Service tax was implanted on services and VAT was implemented on goods. This got done with once GST came into the picture. Now, there is a uniform tax on both goods and services.

3. Distribution

Before the implementation of GST and before anyone knew what is GST, other taxes that were implemented were different in different states. Every state had different taxing systems. However, under the current system, SGST and CGST are collected from the implementation of goods and services. The proceeds are later divided between the center and state.

Earlier, the central government only implemented central sales tax. Different taxes were introduced for different goods and services. A part of the proceeds was transferred to the state government.

With the implementation of GST, there is more freedom to everyone and there is an equal proportion of the proceeds.

4. Input Credit

The dealers of VAT can deduct their input and output VAT on the goods sold. They can deposit this VAT liability. On the other hand, GST calculates the credit for the next liability.

Calculation of the tax liability through the portal system is an additional feature that has been introduced with the implementation of GST. The retailers get to know their input credit which was used during the payment. The retailers have a fair knowledge of their input credit because of this portal.

5. Online Payment

Online payment of VAT is not a compulsory thing. The retailers or customers can choose their mode of payment, even if it is beyond a particular sum of money.

For GST, the online payment becomes compulsory if the amount of tax is more than a sum of Rs 10,000. This new rule has been implemented for the benefit of everyone. It also serves the purpose of transparency among everyone. The government can keep their method of collection open to everyone. It is transparent and honest. Online payments are a more secure and modern way of dealing with things.

6. Declaration System

There was a declaration system under the VAT system. Various forms had to be issued for any transaction that needed to be made. There were forms like FORM C and FORM F. The paperwork was complex and complicated. It was a hassle for consumers and retailers. Dealing with paperwork for a pool of transactions got tiresome. There needed to be a way out of this.

With the introduction of GST, this got done away with. The government realized how unnecessary and burdensome the declaration was. It no longer exists under the GST portal regime.

7. Mode

GST is a very technology-friendly taxing system. We live in a progressive, technology-advanced country. Hence, this change was required. Under VAT, technology was not a driving factor. A lot of paperwork needed to be done. It was more of manual work and it was time-consuming.

Once we understand what is GST, it is easy to see the vast difference between GST and VAT and the impact it has on us now. GST is significantly better for us because of how advanced and revised it is. It took a lot of years to implement it and hence a lot of thought and effort has been put into it.