Will Non-fungible tokens replace bitcoins?

With the success of bitcoins, a lot of different companies are jumping on the bandwagon to create their own virtual currency. This includes Google with Bakkt and and Meta and Metaverse coins. But the strangest one of all are Non-Fungible tokens or NFT for short. Are NFTs going to be a progressive jackpot or are they going to become a Ponzi scheme? Only time will tell, but before you decide to trade in your bitcoins for some NFTs, it would probably be a good idea to truly understand what NFTs really are.

What exactly are NFTs or Non-Fungible tokens?

According to Investopedia:

“NFTs are unique cryptographic tokens that exist on a blockchain and cannot be replicated. NFTs can be used to represent real world items like artwork and real estate. Tokenizing these real world tangible assets allows them to bought, sold, and traded more efficiently while reducing the probability of fraud. NFTs can also be used to represent individual’s identities, property rights, and more.” There is a lot more to know about the NFT Scope.

Wow! So what can possible go wrong? As the saying goes, “When something sounds too good to be true, it probably is.”

Image by Pixbay

What are some examples of NFTs?

One of the most famous examples of NFTs is Twitter’s Jack Dorsey tokenized the first tweet ever written, “just setting up my twttr.” This token had a bid of $2.5 million. Really? $2.5 million dollars for a test message? Wow! So what how much does “Mary had a little lamb. Its fleece is white as snow. And everywhere that Mary went. The lamb was sure to go.” You know.

The very first words recorded on a phonograph. If stupid non-sense Twitter test line is worth $2.9 million, then the first telephone test line should be worth, what? $5 trillion dollars? Because phonographs have had a much huger impact on society, science, and technology than Twitter has. But is anybody really going to pay $5 trillion dollars for somebody saying the childhood poem of “Mary had a little lamb”?

Due to the fairly high value of NFT’s, its fairly common for them to get stolen, since they are just basically digital art. That’s why its important to keep them safe and its easy to do so with Kleptofinder.

How NFTs are different than Bitcoins?

One BitCoin is worth the same as another BitCoin. But the same is not true with an NFT. For example, the first twitter tweet was sold was $2.9 million dollars. While another line can be worth $0.25. Who decides what is worth what?

Think about Picasso Paintings. His cheapest is worth $125,000, while the most expensive is worth $140 million.

What are some technical stuff abut NTFs?

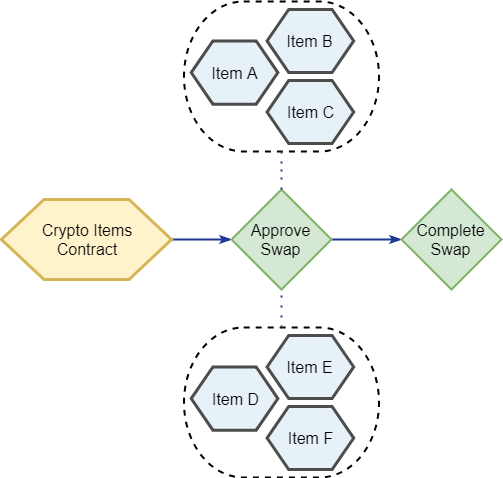

NFTs evolved from the ERC-721 standard. The people who developed the ERC-721 standard also developed the ERC-20 smart contract standard.

ERC-721 defines the minimum interface of ownership details, security, and metadata required for exchange and distribution of gaming tokens. The ERC-1155 standard takes the concept further by reducing the transaction and storage costs required for NFTs and batching multiple types of non-fungible tokens into a single contract.

What is ERC-721?

ERC-721 is the Non-Fungible token standard. These are also called Deeds, but I am not sure if they have the same legal binding as, say, a deed to a car or a deed to a house.

This is an API standard for NFTs within smart contracts. This standard provides basic functionality to track and transfer NFS.

These NFTs can by physical property, like a house or a unique piece of artwork. It can be a virtual collection of collectables, for example, unique pictures of kittens or digital versions of collectable cards. They can also be negative value assets like loans, burdens and other responsibilities.

In theory, NFTs are distinguishable and the ownership of each one must be tracked separately.

What are EIP-20 and why are they not appropriate for NFTs?

The ERC-721 was inspired by the ERC-20 token standard, but EIP-20 is not suffient to handle NFTs.

The EIP-20 is also an API for tokens within smart contracts. The standard provides basic functionality to transfer tokens, as well as allow tokens to be approved so they can be spent by another on-chain third party.

Here is an example of the differences between the two standards.

This is the EIP-20 for a transfer.

function transfer(address _to, uint256 _value) public returns (bool success)

This is the example from EIP-721:

event Transfer(address indexed _from, address indexed _to, uint256 indexed _tokenId);

The main difference between the two is that with the EIP-20 standard, when a transfer is done, only the “from” and “to” are recorded. This is fine for bitcoins, when every bitcoins is the same as every other bitcoin, same as every dollar is the same as every other dollar.

But with NFTs, each NFT is not the same as every other NFT, the same as one painting is not the same as another painting. That is why with the EIP-721 API standard, what exactly is being transferred has to be included in the standard.

That actually makes sense. If you are digitally representing a unique physical item, you have to be able to tell one physical item from another physical item in the digital world.

But what exactly is passed as that third parameter in the API standard?

“NFTs are created when blockchains string records of cryptographic hash, a set of characters identifying a set of data, onto previous records therefore creating a chain of identifiable data blocks. This cryptographic transaction process ensures the authentication of each digital file by providing a digital signature that is used to track NFT ownership. However, data links that point to details such as where the art is stored can be affected by link rot.”

Copyright laws and NFTs

If you are an author or an artist, in the United States, the default rule is that the original author or artists retains the copyright. As for NFTs, there does not seem to be anything inherent about NFTs that would change this default rule as to copyright ownership.

Think about this analogy. An artists sells a physical painting to a buyer. The artist / author is, by default, the copyright holder and will retain the original copyright in the work, even upon a sale to a buyer of the artwork, unless there is some deviation from the general rule. The buyer owns the physical copy and the rights to display that physical copy. The buyer does not have the right to make additional copies. That right is retained by the original copyright holder.

The purchaser does have the right to resell his physical copy to a third party without violating copyright restrictions.

Now bringing this analogy to the digital world and NFTs.

If you were to create and sell an NFT which embodied your artwork (you can see the visual artwork within the NFT) … how does that affect copyright laws. This area of copyright law has not been tested in a court of law. Right now, people are assuming that the author of the original owner of the artwork retains the copyrights to that artwork. So the sale of the NFT is not connected with the sale of copyrights to the original artwork, unless the contract specifically indicates this.

When you buy an NFT, you are buying the NFT and some implied right or license to have limited use of the underlying artwork embodied with the NFT in order to buy, sell, or own the NFT.

But that does not give the owner of the NFT the right to make additional copies to sell.

But what happens when the artwork that the NFT is referencing is not embodied within the NFT? They are two separate entities stored in two separate location, either in the digital world or the NFT is digital and the underlying art work is in the physical world.

What does ownership of an NFT mean in reality?

The area of NFT copyright infringement, NFT trademark infringement, and NFT patent infringement is not fully developed. Is your intellectual property protected or not protected? At this point, either the laws need to be more clearly developed or else test cases will have to go through the court system.

Artists are already saying that their artwork is being created into NFTs without their permission and knowledge.

Currently, there are not centralized platforms for NFTs to help protect this type of intellectual property theft.

When was the first NFT created?

The first NFT was created in 2014, and was launched in October 2015. But the ERC-721 standard was not created until 2017. So before that time, it was really possible to actually buy and sell NFTs digitally before then.

By March 2021, more than $200 million were spent on NFTs.

Are NTF sales going to continue to grow?

The speculative market for NFTs has led more investors to trade at greater volumes and rates. The NFT buying surge was called an economic bubble. This is similar to dot-com bubble. By mid-April 2021, the demand for NFs appeared to have substantially subsided causing prices to fall significantly.

How are NFTs actually stored in their digital version?

Some NFTs store the NFT with the underlying digital artwork. But since an NFT can represent an object that exists in the real world, it is also possible to create a valid NFT that does have the digitized version of the artwork embedded within it. This is even true with digital artworks. The NFT can be stored in one location, and the digital artwork can be stored in a separate location.

Sarcasm on … no problem there, nobody has ever experienced link rot to digital images that were created during the 1990s or early 2000s on the internet — sarcasm off.

Yes, link rot is the number one reason why in 15 years, or probably even 3 years, the image behind the NFT that you just purchased is not even going to be worth the 1 and 0s it was originally created with.

NFTs are functionally separate from the underlying artworks. The bottom line is that NFTs really have no protection in the real physical world of what they are supposed to be really representing in the physical world.

Summary

After doing a bit of research and writing this article, I still do not understand the value of an NFTs. I can understand the value of buying digital piece of artwork, where you get ownership of that piece of artwork and maintain the digital rights to that image. That makes sense, but that is not what an NFT is. the NFT seems to be just a record that you brought “something” for a digital image. Legally, right now, I can sell you a digital image that I did not create and have no connection to, just because I can.

Why is that a good investment?

And paying $2.9 million for “just setting up my twttr”. What is next? Somebody buying $2.9 trillion for “Mary had a little lamb” (first phonograph test phrase)! (This did not actually happen. I am just make a point.)

I know that “Art is in the eye of the beholder”, but it seems NFTs to me seem more like “A fool and his money are soon departed.”

Cover Image by Freepik