The Evolution of Frictionless Payments

Frictionless payments are essential for ecommerce platforms to reduce the barriers between online shopping and completed checkouts. The buying process needs to be easier for both the customer and the seller, as an enjoyable user experience leads to higher conversion rates and fewer abandoned shopping carts.

Effective frictionless payments are essential for both large and growing businesses. When done right, frictionless payments improve the checkout process by eliminating waiting times, which creates a faster checkout experience. It’s all about reducing barriers and the steps towards a completed sale. Ultimately, frictionless payments should feel like a natural part of the customer experience.

Understanding how frictionless payments have developed and reviewing the history of buying processes will help us understand how businesses will be able to continue their growth in the digital age. So, let’s explore the evolution of frictionless payments and predict how businesses will drive higher conversion rates and create better customer experiences in the future.

1950: Debit and credit cards

The credit card was developed in the mid-twentieth century, but it wasn’t until 1973 that the card payments system was computerized. This frictionless payment reduced transaction times to just one minute and gave rise to the era of electronic consumer payments. Computerized payments would eventually allow for future online transactions, where ecommerce businesses could contact banks to finalize payments with ease. In 1994, Stanford Federal Credit Union in California was the first financial institution to offer online internet banking, leading the way for online transactions to begin in 1995.

1999: 1-Click

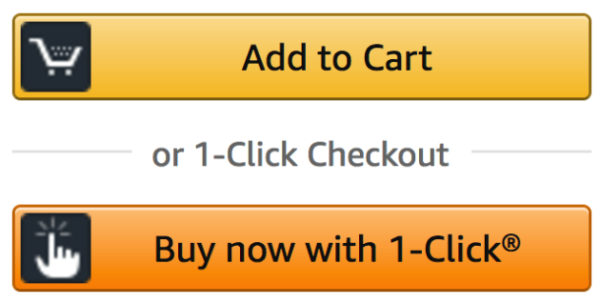

Bookseller turned global conglomerate Amazon patented an online transaction process called ‘1-Click’ in 1999. This allowed customers to buy products with just a click of a button. Items could be purchased at the product level without adding to a shopping cart, meaning that customers could buy a product in a flash. Voila: no shopping cart abandonment. With 1-Click, personal details and your bank account details are stored online, safely assuming that users are content with the same delivery address and bank account being used for every transaction.

The patent has since expired, meaning a flurry of businesses can now utilize this frictionless checkout method. Given the global average rate for shopping cart abandonment is 69.8 percent, skipping over the shopping cart means that ecommerce businesses can maximize their conversion rates and generate more sales through this simple process.

2003: Chip, pin, and tap

Going back to credit and debit cards, a more recent development contributed to the evolution of frictionless payments. In 2003, the introduction of Chip and PIN in the UK allowed cards to store data in a small chip on the face of a card. This data could then be accessed using a four-digit PIN, authorizing the payment. The American conversion to chip and PIN was announced in 2012 and completed in 2015.

Not only did this process increase efficiencies for both customers and businesses by automatically authorizing payments rather than signing a receipt, but it also curated a secure form of payment. Only those with access to the card and the secret PIN could access the account. The advance demonstrates how frictionless transactions can be made easier, but importantly, more secure at the checkout.

Contactless payments were introduced in 2007, making the checkout process even easier. Today, one in five card payments is contactless.

2011: The mobile revolution

As mobile phones became smaller, they became as much an essential accessory as a wallet or purse. They’re with us all the time. So, it’s not surprising that these handheld devices have become ingrained in the checkout culture. Leading mobile manufacturers, Google, Apple, Android, and Samsung all launched digital wallets between 2011 and 2015, allowing users to complete transactions with them rather than their debit or credit cards.

These transactions had the added security benefit of authorizing payments through a fingerprint or facial scan. Furthermore, these digital wallets could be used in-store or online, storing personal data to automatically fill in those arduous forms with personal details, delivery addresses, and billing addresses. The innovation helps further speed up online sales and transactions.

Now and the future…

As online transactions become easier and quicker on the customer side, some obstacles for businesses to achieve a completely frictionless payment remain. Businesses must ensure that they balance the risks and rewards that come with streamlining checkout. However, there are ways to ensure protection from fraud and abuse for both businesses and customers.

As the popularity of omnichannel sales, digital wallets and one-click buying continues to develop, innovative ways to maximize sales without being affected by fraud and abuse have been developed. Commerce protection platforms, such as Signifyd, drive automated decisions on all transactions, approving more good orders and recovering lost revenue from chargebacks. This streamlines the customer experience, limiting the need for authentication forms and processes. Overall, commerce protection platforms feel like a natural part of the checkout process, going unnoticed by customers, and they can increase conversion rates by four to six percent on average.

Frictionless payments will continue to improve, creating better customer experiences and improving business performance. As more sales move online and transaction speeds and efficiencies increase, it’s important to tackle attempts of fraud and abuse. At every stage of the evolution of frictionless payment, new processes are helping to make every transaction safer and more worthwhile for customers and businesses.