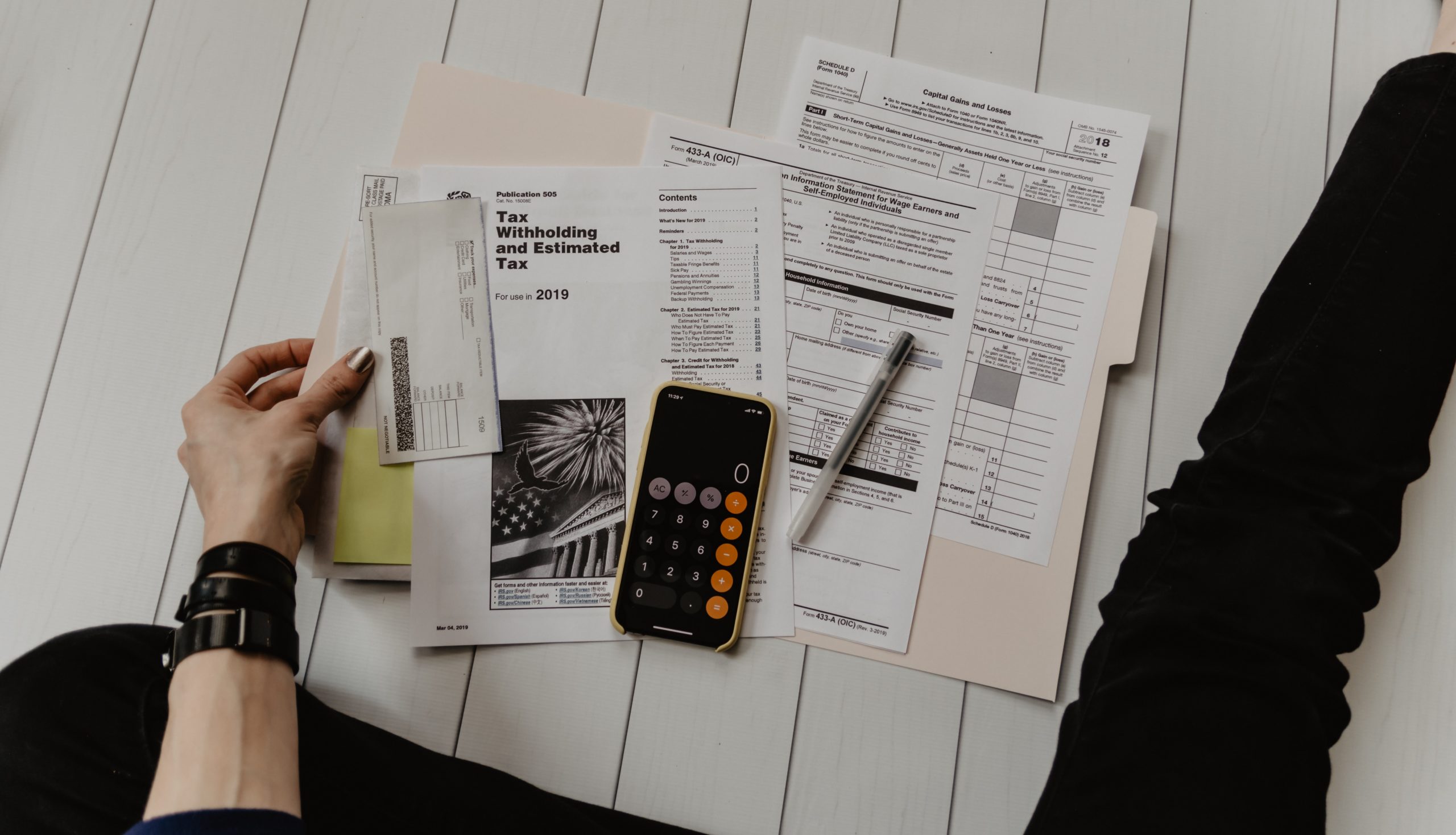

Calculating expenses and income in a notebook, like in Excel, is no longer relevant. There are mobile applications for this. The application helps to form his own financial plan and tells the user how much money can be invested every month or saved for large purchases. To do this, you must indicate income, mandatory payments and all planned expenses – including by category for financial software development company. But those who use mobile applications often complain about the inconvenience of programs, even with a paid subscription. But still there are reliable fintech applications.

What are the types of financial applications?

The relationship between people and money is a very curious and controversial topic. How often among people with average earnings one can hear the remarks: “There is still a week to pay, but there is no more money from the last one”, “How much I spent in the store! We’ll have to save on food for a month ”,“ What do you mean – put it off? I can’t save. ” Interestingly, the reason for these remarks is not always hidden behind low income levels. In most cases, people’s ignorance in the field of finance is to blame for this.

One of the ways to increase a person’s financial literacy is the introduction of mobile applications for managing a personal budget. But how to choose a good, and most importantly, one that takes into account the individual preferences of each consumer, an application that will teach him to control his home “treasury”? Financial technology industry has answer on this question and conducted a large-scale study of mobile applications for personal finance accounting.

Best financial software applications

The variants are numerous and there are different categories of applications software for any taste. The best between them are Money Manager for iOS, Android, which is a classic personal finance app. Also this is Bills Monitor for iOS, Android, Goodbudget and many other options.

Requirements for financial apps

We hope that step-by-step instructions will help you when choosing an application for accounting for personal finances:

1) Determine what is most important to you: ease of use, advanced functionality and work with a large number of accounts, the ability to create budgets or build analytical reports, etc.

2) If you prefer to record and analyze expenses on a computer, pay attention to the availability of a web version of the application or a version for a PC.

3) Depending on your preferences, choose the optimal product. It at the same time would correspond to the proper level of security. It’s easy to use, had a high level of stability and was accompanied (updated) by the developer.

The future of financial application development

Mobile banking from https://alty.co/ has long been able to categorize your expenses. However, he does not know anything about your cash and does not know how to plan the budget in advance. Applications will help you put your finances in order and calculate your budget for several months or even years in advance.

Final Words

Well, a summary table of tests will help you find the optimal mobile application that meets all your requests. It has filters that allow you to focus on any of the program’s parameters. Thus, each consumer has the opportunity to adjust the rating parameters so as to choose an application taking into account all personal preferences.

Photo by Kelly Sikkema on Unsplash