The 4 Best Alternatives and Competitors to PayPal

In this day and age, it seems like Paypal is an unstoppable force that dominates the realm of payment gateways with a gilded fist and a giddy grin. Over the last couple of years, Paypal became almost synonymous with any form of online payment systems.

However, Paypal is not end all be all of the payment gateways. In fact, there is actually rather active competition between various payment gateways and Paypal position is not as solid as it seems. You have old school Authorize.Net, Paypal’s own Braintree and a dynamic clash of Stripe vs Square in quest of getting better. All of them offer a different kind of experience that more and more users find attractive.

What’s the problem with Paypal?

Paypal is like Hulk Hogan — 50% media creation. It was hyped up beyond belief and that gave it an additional momentum. The fact of the matter is — Paypal is good for ground level transaction, but there some problems that Paypal struggles to deal with when it comes to significantly large sums of money.

Another biting issue is with security. There are flaws in the security systems of the gateway that enable account hijacking. That may lead to blocking. And sometimes this blocking happens just because of the glitch in the system. While chances are slim — even the slightest possibility of such turn of events may cause reasonable concerns.

What are alternatives to Paypal?

On the other hand, it is completely unreasonable to keep all eggs in one basket. It is simply too dangerous from a technical point — one glitch can derail everything. Next, you have to provide a variety of options for customers. Finally, some gateways better fit for certain operations than the others.

Let’s look at 4 best alternatives to PayPal that pose a serious competition to the “big guy”.

Stripe

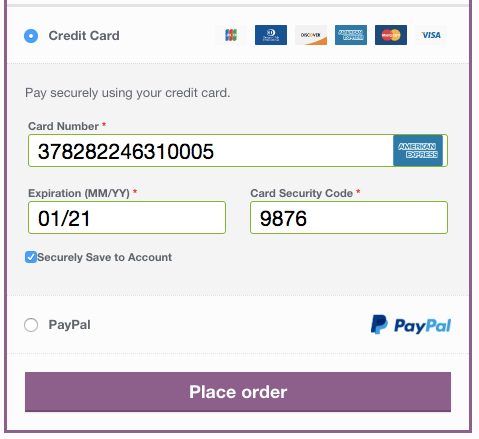

Let’s start with a hard hitting, kiss stealing styling, profiling son of a gun known as Stripe. It is probably one of the two biggest competitors to Paypal (the other is Square). It positions itself as a better payment gateway in every way. Stripe claims to have superior systems of fees, more elaborate features and smooth user experience.

While it is not exactly there yet but you can see an effort. Stripes biggest asset is that it easily integrates into the site and lets customers perform transactions without those pesky and sometimes questionable redirects.

Another good thing is its fraud detection system. There are thorough credibility checks that keep away much of the malicious things. You can rest assured that no one will hijack your account. Fees are relatively low and the chargebacks are not as biting as with Paypal.

However, all this goodness requires some programming skills to get going. But it is not much of a problem if you think about it.

Square

The word that best describes Square is “barebones”. Square is a payment gateway that offers an absolutely different approach to online transactions — let’s describe it as “no bullshit just business”. And it is pretty attractive to a significant user base who are fed up with long and winding processes and overly complicated integration.

From UX standpoint — it is much like Paypal without an excessive fat. It gives everything you need to maintain steady operation without breaking into tears.

Square is very firm and reliable gateway for diverse types of payments. As such, Square fits best for small-scale operations. The fees are relatively low. In addition, they are all fixed and there no additional fees to worry about.

Authorize.Net

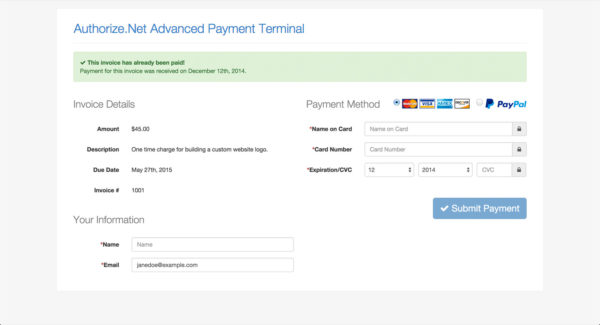

Authorize.Net is one of the oldest payment gateways out there. It was there from the very beginning. Longevity helped to build a trustworthy relationship with its user base.

Authorize.Net takes an additional step in order to secure the safety of user’s information. Otherwise, Authorize.Net is rather easy-going in terms of the relationship with its users. It provides you with instruments to do your thing and if it is within legal boundaries — it will not intervene.

One of the biggest assets of Authorize.Net is its user-friendly approach. You need just a couple of seconds to figure out what to do. Integration is smooth and brings no trouble.

What stands against Authorize.Net are the fees. Setup fee is $49, monthly gateway is $25, chargebacks are $25, plus 1.5% for international transactions. That might be rather biting for a nascent company.

Braintree

Let’s cap things off with a little bit of cheating. Braintree is a division of Paypal. But it offers slightly different services and somewhat different experience from its big brother.

In essence, the main difference between Paypal and Braintree is that the latter is better fitted for elaborately structured payments.

Braintree is easy to integrate and relatively easy to use (if you know how to online store stuff in the first place). It is a perfect fit for online stores and merchants. As such it requires well-oiled scalability and hopefully, it manages to maintain large workloads without going down.

The pricing is standard but you get a lot of features to play with so it is really a win. The downside is that it requires some technical tweaking before it gets going and it might a little bit complicated if you are not into it.

Conclusion

As you can see, Paypal is not the only game in town. It might be still the biggest, but that is more of a question of time than anything.

One thing for sure, competition is a good thing for every payment gateway. It gives them much-needed drive to make their services better than the competition and that leads to overall improvement of payment gateway business.