Financial Inclusion – No Longer an Exception!

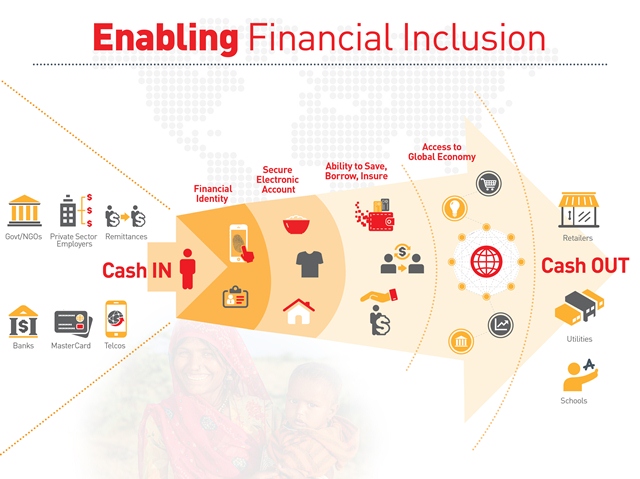

The world is getting smaller and financial inclusion is steadily becoming a rule, not an exception. Sample this-according to The little Data Book on Financial Inclusion 2015 (TDB) released by the World Bank’s Development Research Group, 62 per cent of adults across the world now have an account at a financial institution or through a mobile device, compared to 51 per cent in 2011. This increase is being witnessed among the most economically backward populations in most regions, driven by mobile technology, digital payments, reforms that encourage correspondent banking, and relaxed customer identification. Let’s move a step ahead-it is no secret that mobile phone usage has spread far and wide, literally to the far corners of the globe. So, naturally, these devices, through the advent of mobile money, have played a very vital role in extending financial services to the underserved.

Before we begin applauding though, (and I hate to be a wet blanket), while financial inclusion has indeed progressed remarkably around the globe, there do exist certain regions where the progress has been just a tad bit slower than the rest of the world. Enter TDB yet again-in Europe and Central Asia, 51.4 per cent of adults have an account at a financial institution and 0.3 per cent holds an account via a mobile device. Just a quick side note-TLB has listed the following countries as Europe and Central Asia-Albania, Armenia, Azerbaijan, Belarus, Bosnia and Herzegovina, Bulgaria, Georgia, Hungary, Kazakhstan, Kosovo, Kyrgyz Republic, former Yugoslav Republic of Macedonia, Moldova, Montenegro, Romania, Serbia, Tajikistan, Turkey, Turkmenistan, Ukraine and Uzbekistan.

In short, all banks and other financial institutions, please sit up and take note-there still exist countries that are ripe for financial services-mobile and otherwise. Not just that, countries with a large immigrant population presents an excellent target segment. So, go back to the drawing board and start outlining a viable strategy.

While we’re on that subject, it would be pertinent to point out that Sub-Saharan Africa and South Asia are two major success stories in this regard. Let’s look at a few hard facts- according to the GSMA’s 2014 State of The Industry Mobile Financial Services for the Unbanked report, of all regions, Sub-Saharan Africa recorded the highest level of mobile money penetration. By December 2014, 23 per cent of mobile connections in this region were linked with a mobile money account, whereas smartphone connections only represented 16.4 per cent of total mobile connections in this region. If that isn’t progress, nothing is! To cut to the chase, it would be worthwhile to examine how these regions leveraged the power of mobile money to see if the same can be adapted to suit the terra firma of the regions in question.

Europe and Central Asia isn’t all that backward, though. The region is catching up, albeit slowly. Last year, in what has been rather cleverly cited as a “trend reversal” by several publications, African technology migrated to Europe, with the launch of Kenya’s “M-Pesa” mobile money transfer system in Romania. The concept is simple: “M-Pesa” customers can receive and send money through their mobile phones using simple text messaging technology. Why Romania, you ask? Well, only about 60 per cent of the population has an account, the rest still mostly depend heavily on cash. In fact, it is believed that even Romanians who have bank accounts mostly use them to withdraw their salaries. They then depend on cash transactions for the rest of the month. Isn’t that enough of a business case right there?

However, chalking out a strategy for unbanked and under-banked folks in the region under scrutiny (Europe and Central Asia) is just one part of it. Let’s move onto the 51.4 per cent who have an account at a financial institution and the 0.3 per cent of customers who do hold an account via the mobile phone. For them, banks and financial institutions need to remember one golden rule-ensuring convenient and easy service is the name of the game. Seems easy but consider the stiff competition such players have to face from the Apple Pay, Google Wallet and the Samsung Pay’s of the world. To illustrate-as per a press release issued by Apple, since its launch, an increasing number of banks and credit unions have added support for Apple Pay, currently representing about 90 per cent of credit card purchase volume in the US. Leading merchants including Bloomingdale’s, Disney Store, Duane Reade and Walgreens are letting their customers enjoy the ease of use, security and privacy of Apple Pay. Stiff competition, that!

The stakes are high and to stay in the race, banks and financial institutions ought to offer a mobile payment system that holds appeal for customers and merchants alike. More simply put, the system ought to hold its own with regard to convenience, user experience and security and cost. In all fairness, banks and financial institutions do face certain unique challenges. For instance, typically, such a player would partner with a telecom operator to launch a Near Field Communications (NFC)-based payment system. Therein lies the challenge of making its presence felt in the crowd. But now, the latest kid on the payments block- Host Card Emulation (HCE) has shaken up the status quo. Allow me a bit of jargon- NFC using a secure element (SE) for contactless proximity payments had too many challenges which HCE has resolved. The tokenization service offered by card schemes would enable financial institutions to launch NFC Wallets by simply working with a mobile wallet platform provider. Sorted?

Last but definitely not the least; let’s talk about the merchants involved in this juggernaut. Now, to quote TDB, only 36.9 per cent of the population in Europe and Central Asia holds a debit card. Clearly, cash is still the king in that region! So, the first task before banks and financial institutions is to improve and enhance uptake and acceptance of cards. How does one do that? Well, for starters, encouraging small and medium merchants to switch from traditional point-of-sale (POS) terminals to a mobile POS (MPOS) may help. The idea is to highlight the advantages of the MPOS. Not only do such devices potentially drive down the price of regular POS terminals by as much as 50 per cent, they offer significant value adds such as EMI payments, mobile top-ups, payment analytics and even cash and check reconciliation via its mobile app.

Wait, there’s more-the leaning towards cash only strengthens the business case for a MPOS device, as it opens up an affordable channel to accept alternate forms of payment, from cards to the mobile handset. For bigger merchants, MPOS could provide support in managing the workforce, sales force etc. by providing mobile-based inventory management, automatic sales records, etc. A win-win situation?

Conclusion

The message is straightforward-financial inclusion and payments are evolving rapidly every day. The need of the hour for banks and financial institutions is to chalk out a multi-pronged strategy for all segments (i.e. the banked, the unbanked and merchants) to not only stand up to stiff competition but to remain relevant in this space.

About the author:

Steve Summers recently joined MahindraComviva as Senior Vice President and General Manager of the Europe region. He is a veteran of the mobile telecoms industry, having held executive roles at Movius Corporation, Mavenir, Openwave Systems and Comverse in his over 25 year career. Having seen a general movement towards service convergence and the convenience of an all-powerful mobile device, he sees mobile commerce as a great opportunity for banks to open new markets through the embracing of mobile technology. But are the MNO’s ready to face the challenges of the mobile financial services paradigm in the mature and crowded European marketplace?