Things Cryptocurrency Enabled in the Modern Fintech World

What is the one common thing between paying for a coffee in the US, travelling the country of El Salvador and hitting an online cashback casino have in common? The answer is “Crypto-currency can be used for all the cases”. And this answer is actually preferred in many cases. Crypto is reshaping finance and financial technology and a positive impact can be observed already. In this article, I will discuss a few things cryptocurrency has enabled in the modern era of fintech.

Cross border payments in seconds

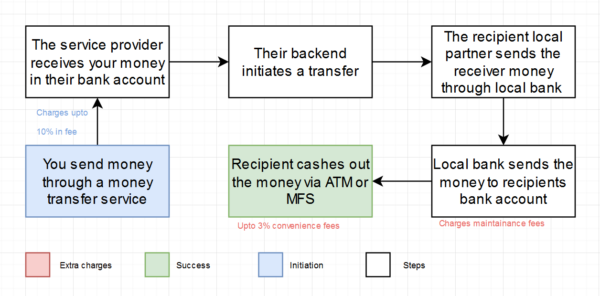

Many people work or live in a country far from their birth land and they still have connections back there. Oftentimes you may need to transfer money to your relative or friend who lives there. So what does our traditional financial technology provide for us? SWIFT Wire is a popular way, but is not fast enough and has too many intermediaries. Alternatively, let’s see the flow when you send money to another country via a money transfer service like Wise, Western Union or MoneyGram:

These extra steps require multiple parties to be involved in the transaction and charge extra on each step. No matter how hard you try, you and your recipients both end up paying extras. You also spend on exchange fees too if you are sending money in a different currency than the recipient. Then the recipient has to pay charges to cash them out. Not every country has gone totally cashless, so there are still expensive charges for both traditional banking and mobile banking. This is not the biggest issue of this method, the real issue is time. Each of these steps requires more and more time after initiation. And if you have to send money on weekends, get ready for suffering. It takes upto 10 days to complete a transfer this way which is just too much.

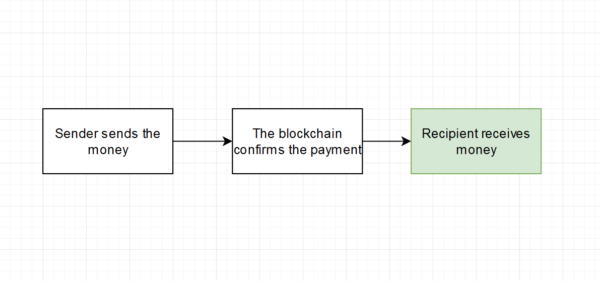

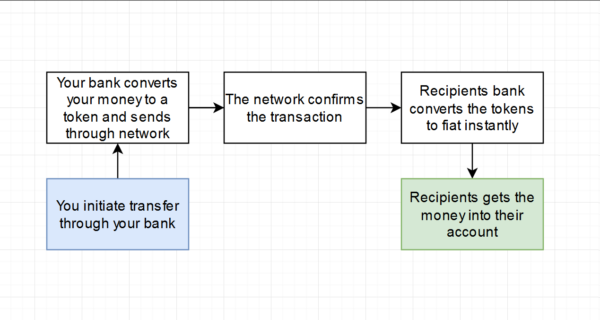

Introducing peer to peer money transfer. Instead of paying multiple parties processing foreign payment, exchange, local partner, local banks, cash booths, you pay once and you’re all good to go. The flow is kind of like this:

As you can see, there are no middlemen, just the network confirming and validating the transaction. And you pay your fees once. ETH and BTC networks always charge high, but some networks are designed for cross border payments, so they charge a very low and often fixed fee. Networks like Stellar charge as low as $0.000004 per transaction and you can see how affordable that is. With crypto, there can be and will be a solution that will allow us to transfer money in seconds regardless of country and currency.

Due to the network charging way less than traditional payment processors and exchanges, they end up spending less on transactions, and thus it reduces transfer fees and other charges. And the transfer happens instantly. Stellar Network can process 1000 – 5000 transactions per second. That is upto 300000 transactions per minute and upto 432000000 transactions per day! With constant updates released by the developers behind Stellar, it can be much faster than this. Crypto has enabled this marvellous way and this is maybe the future of cross border payments.

Easy payments for vendors

With cards and mobile payments being the norm, payments are instantaneous and easy nowadays for the consumer. But for the merchants, integrating and taking payments in a traditional way is complicated and full of issues. When I was talking to Sunit Kumar Nandi the founder of Techno FAQ and Letter – a privacy centric email provider for regular and enterprise usage, I got to hear some pretty interesting stories. He says:

“Discrimination against smaller merchants, huge barrier to entry, too much paperwork and compliance that actually has no meaning makes traditional payment providers very unfriendly.”

In short, just like we discussed earlier, this also suffers from “multiple party involvement for a single thing”. Payment mechanisms can be much simpler with crypto instead. Welcome to the world of crypto where the payment system is much simpler. Every transaction is peer to peer, but there are startups and fintech companies that are working with crypto payment to make it more merchant friendly.

Companies like Coinbase provide support for payment with multiple crypto-currencies and they charge very low fees. CoinsPaid lets your customer pay you in crypto and then convert and settle fiat currencies like USD and EUR to your business bank account. The KYC and integration process is much simpler and you end up paying lower than PayPal or Stripe.

Travel the world without foreign currency endorsement

Lots and lots of countries are accepting crypto-currency as legal tender. Even India legalised crypto in 2021. So if you’re a traveller, you will love this. Imagine if you are travelling in various countries. Now, with traditional banking, the buying and exchange process is okay, but not great. With crypto, it can be even better. Instead of endorsing your passport for foreign currency everytime you leave your country for travel and then finding exchanges, cashing out at an expensive ATM, you can pay in local currency in many ways thanks to crypto currency.

All this thing can be much simpler, with many services offering crypto backed debit and credit cards. Many places you can just use your wallet, but in places where crypto is not legal yet, you can still use your crypto with many fintech companies offering solutions. Coinbase Visa Card lets you shop anywhere and supports various crypto currencies. You swipe your card, and it pays for your trips, foods, hotels etc. This is not the only option. Various other cards are available too. Cards like Wirex and BlockFi are all powered by crypto.

Conclusion

Many of the things I talked about in this article are in the pilot phase, but we can expect a widespread adaptation within 2030. Traditional systems of finance have been deemed unworthy and unfriendly and crypto has proven to empower people. Modern Fintech is adoring crypto and the technologies behind crypto and more startups are forming with new ideas to accelerate on this idea. Crypto can enable the Fintech market to grow more, invest in new ideas and bank the unbanked. Cryptocurrency helps Fintechs reduce the prevalence of frauds and thefts, and increases security. Recently Upay from Bangladesh built their MFS wallet on top of Hyperledger in a country where crypto is banned. This shows how the Fintech market is benefitting from crypto and the technology behind it.