All you need to know about the new Apple Credit Card

The world of credit cards is about to experience a paradigm shift. In the summer of 2019, Apple is set to release their credit card.

According to various reports, the card will come with many benefits. What are the benefits that cardholders will get?

If you want to know why every other person is talking about this virtual credit card, here is everything you need to know about it.

The Apple Card by definition

The Apple credit card is like any other that you know. However, the difference is, you do not have to always walk with the credit card everywhere you go. Users can apply for the card by accessing the wallet app on their Apple devices.

Whether or not it will be available for Android devices, it may be unclear for now since it is soon to talk about that. Nonetheless, the credit is accessible through all iOS versions.

Additionally, the physical card is unique. The cover features a titanium coating. With the metal being one of the hardest metals, it might difficult to break it.

How do you access the amount in your card?

You do not need to memorize any passwords. Your credit card will operate from your phone. After signing up, users can access their accounts by using the Face unlock ID. That means no one else can use the card unless it is you.

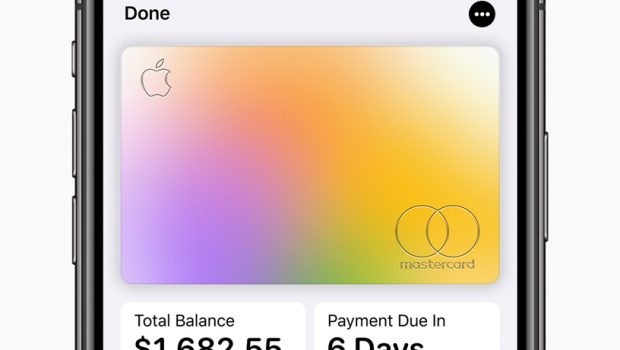

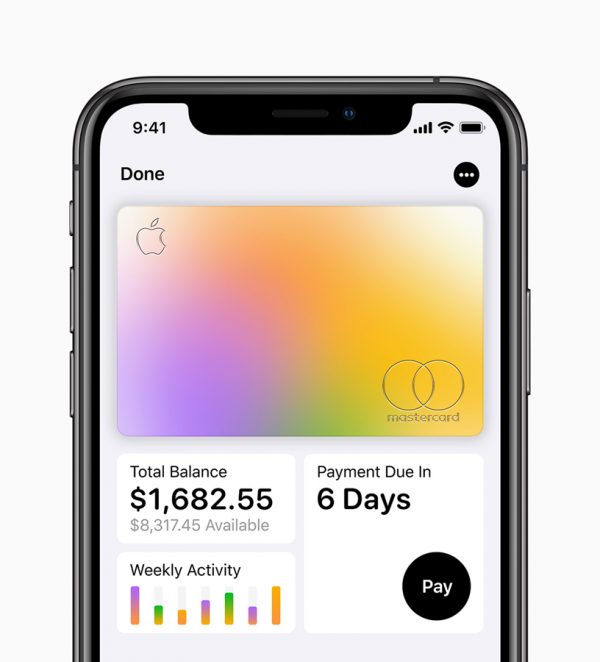

After logging into the account, you can view the available balance, your spending tendencies, and personal details.

You can earn bonus cash after spending

Users can spend as much as they want. You can buy anything with it, and I mean anything.

Besides that, the Apple card provides discounts. You get back a particular percentage of cash used after purchasing something.

In other words, you will get 3 percent when you buy any Apple product; 2 percent with every purchase you make through ApplePay; and 1 percent for any purchase not related to apple.

You will get the amount back into your account immediately. It is accessible without limit or delay, and you can use it to make purchases.

Analyze your Spending tendencies through this card

Users will also get the advantage of viewing their daily, weekly, and monthly spending sheets. It categorizes each purchase. For instance, hotel purchases collect in one location, and entertainment purchases cluster in a different category.

In the case you cannot remember a purchase you made, you click on it. Guess what? It shows you a map indicating where you used that amount.

You can pay low-interest rates

You should not expect any bonuses when you sign up for these services. Nonetheless, Apple does something that most credit card merchants rarely do.

They will encourage you to pay low-interest rates. During payment, the system calculates what your interest will be depending on your payment schedule. Additionally, there are no late payment penalties or even hidden fees. Every transaction is transparent.

If you notice any unusual transactions, Apple allows you to send them a text. They will reply to you instantly.

Final Verdict

Apple Card is a reliable credit card since it comes with multiple benefits. You should sign up through their website. By the way, if you make a purchase, and you notice that the store does not use Apple Pay, you can use the physical credit card at that time.

Every transaction will still show on your wallet, including bonus points. The credit card company also put a high emphasis on security. It is difficult for anyone to use your card.

![Women of the Fast and the Furious [Infographic]](https://technofaq.org/wp-content/uploads/2017/05/women-fast-furious-150x150.jpeg)