Cryptocurrencies trading opportunities

Cryptocurrencies are digital assets or the equivalent of digital cash used to transact. Some would consider them commodities other as currencies. While some investors see them as a long-term store of value others are actively trading them for massive gains. But what Cryptocurrencies have in common and what makes them truly unique is their decentralization and the underlying Blockchain structure.

Put simply, transactions happening using a certain Cryptocurrency are grouped in Blocks. These blocks are secured by means of cryptography and together, they form the Blockchain. The Blockchain is also referred to as a distributed ledger because it is an open “Book” recording all validated transactions on the network.

Top Trading Cryptocurrencies

Bitcoin, invented by Satoshi Nakamoto in 2009, was the first decentralized cryptocurrency. Bitcoin’s price has always been in the spotlights as it went from 100 USD in 2013 to an all-time high surpassing a $10,000 mark in November this year.

Next to Bitcoin, Ethereum and Litecoin are also two favourites amongst traders and investors. Litecoin, created by Charlie Lee, is very similar to Bitcoin but with additions that makes it scalable, faster to generate than Bitcoin and with much lower transaction fees. In just 2017, litecoin hit an all time high of 92 USD which represents a 1400% increase for the year.

Ethereum is a distributed public blockchain network co-founded by Vitalik Buterin and Gavin Wood. Ether, on top of being a tradable cryptocurrency, is the currency used to pay for transactions and services such as smart contracts on the Ethereum network.

Since inception, Ethereum has been very popular with fortune 500 companies such as Microsoft and Intel who joined the Ethereum Enterprise Alliance. The “EEA” has quickly become the world’s largest Open source Blockchain organization. This popularity reflected positively on Ether price that surged from 9 USD in January 2017 to above 400 USD summer 2017.

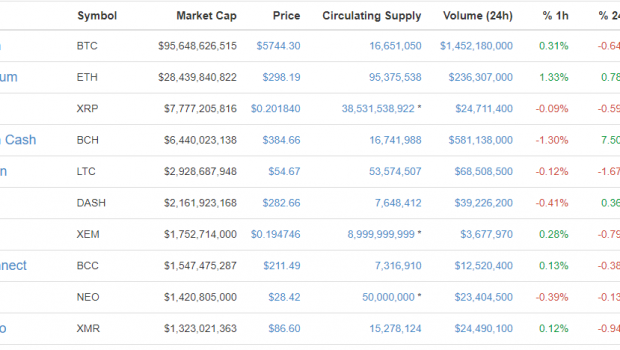

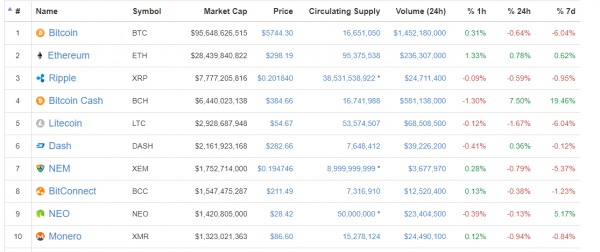

The impressive performance of Cryptocurrencies and the growing adoption is shown by Cryptocurrencies’ total market Cap currently exceeding $150B. At press time, Bitcoin’s Market Cap is at $95,85B. Ethereum’s Market Cap at $28,47B and Litecoin at $2,93B.

3 Key factors influencing Cryptocurrencies’ prices and market cap

The demand for cryptocurrencies has a direct impact on the price and is largely driven by the acceptance of these cryptocurrencies by merchants, exchanges and users. It is also driven by the intrinsic value users and investors see in the Cryptocurrency.

Regulatory attempts and bans can impact both the demand aspect and the investors’ sentiment towards the cryptocurrencies market. A good example was the Chinese crackdown on Cryptocurrencies and ICOs on September. Within 10 days, Bitcoin went from 5000 to 3350 USD on the 14th of September.

Security, nevertheless, remains the main sentiment factor driving Cryptocurrencies price. A good example is the massive hack in 2014 leading to the collapse of MTGox or what was the world’s largest Bitcoin exchange. The hack lead to a loss of more than $450 million worth of Bitcoin, 6% of the Bitcoins in circulation back then. Bitcoin’s price crashed by more than 25% instantly.

Why trade cryptocurrencies?

Cryptocurrencies are attractive assets to trade and there are multiple reasons why traders are rushing to trade them:

Cryptocurrencies are highly volatile, offer total transparency regarding the current prices and most important, have strong trends, easily recognizable from trading graphs.

These factors are important for investors and traders to remember when building their strategy and thinking how to trade Bitcoin. In fact, Bitcoin has been on a strong uptrend for the last 4 years and regularly makes new all-time highs, backtests the breakout level to resume uptrend and reach another new all-time high.

Cryptocurrencies also benefit from a vast news coverage every time there is a massive price run or flash crash. This contributes to their growing popularity making them an interesting choice for investors especially from a Portfolio diversification perspective.