Fuelled by HCE, the pay rush gathers momentum

The consumers across the world are steadily relying more on mobile payments rather than dipping or swiping their payment cards. MasterCard has announced support to Host Card Emulation (HCE) in order to ensure secure, remote and contactless payment transactions and thus, several projects are underway to significantly delight the consumers with more mobile payment experience options across the Android device platform. This will in turn increase revenue options for the service providers and the mobile payments scenario will change entirely.

Initially, a hullabaloo was created in the market-space consisting of banks and other financial institutions with the advent of mobile payments. The arrival of NFC (near field communication) technology for mobile payments was anticipated to be accepted whole heartedly by the users, which would have helped the contactless payment system jump start its journey on a decent note. But, NFC payments were dogged by security concerns.

Following all this, the Secure Element (SE) – a tamper-proof platform capable of securely hosting applications along with their confidential, cryptographic data in accordance with the security requirements- made its way to the payment space. But, the requirement of changing SIMSs couldn’t let it enjoy acceptance among the consumers.

Introduction of HCE to mobile payments

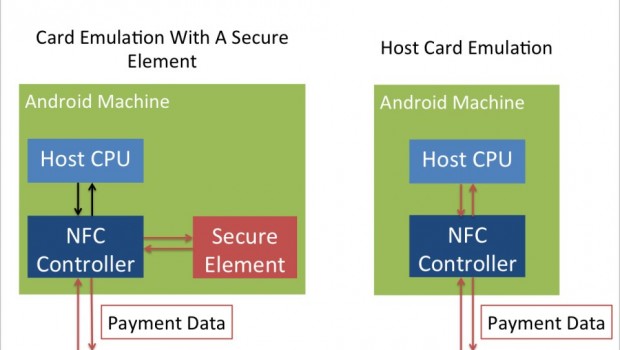

Host Card Emulation (HCE) is a device technology that enables a phone to perform card emulation on an NFC-enabled device. The device does not have to rely on access to a secure element. It arrived as an alternative option to SE (Secure Element)-based approach for digitizing the user’s card credentials through tokenization into the smart devices. Gradually, the cloud based payments started gaining acceptance and now HCE serves as a foundation for rapid deployment of mobile payment services across the globe. The HCE-integrated approach for mobile payments fastens the deployment process of the contactless mobile payments offerings for the financial solution providers and more importantly for the banks. Resultantly, numerous licenses have embraced the framework in order to ensure thoughtful outlining and a more secure deployment of mobile payments.

How is Host Card Element (HCE) more secure than Secure Element (SE)?

Before the HCE support started being offered with mobile payments, the user’s mobile payment credentials were stored inside the secure element on the mobile device. With Host Card Emulation, the SE can be present on the cloud storage. This in turn reduces complexities as well as costs. The technology can help the mobile wallet applications get converted into a virtual smart card. HCE gained more importance by further pushing the payments enabling direct communication between the merchants and the banks without any intermediaries.

This not only shortened the process but it also made easier for the banks to offer a more cost-effective mobile payment service. Before this concept came into existence, the banks required communicating to the merchants through the mobile service providers and this not only made the process tedious but also it added to the costs. Thus, it will be easier for the banks to launch different contactless payment services.

![Top 5 Tips to Boost your Construction Company’s Profits [Infographic]](https://technofaq.org/wp-content/uploads/2018/07/Top-5-Tips-to-Boost-Your-Construction-Companys-Profits-150x150.png)