Bitcoin Halving Explained – What is it and How it Works

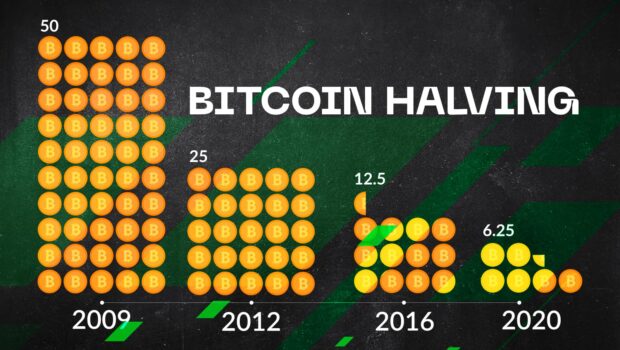

Bitcoin halving is a process that occurs every 210,000 blocks and reduces the number of new Bitcoins created by 50%. The next Bitcoin halving will happen on or around May 2020. This event marks an important milestone in the history of Bitcoin and could have a significant impact on its price. You can also visit https://meta-profit.net/ for further details.

Why does Bitcoin halving happen?

The Bitcoin halving happens because the number of Bitcoins in circulation is designed to be finite. The total number of Bitcoins that will ever be created is capped at 21 million. When Satoshi Nakamoto, the creator of Bitcoin, mined the first block in 2009, he set a schedule for halvings that would eventually lead to this limit being reached.

What are the consequences of a Bitcoin halving?

The Bitcoin halving could have a significant impact on the price of Bitcoin. This is because it reduces the supply of new Bitcoins entering the market. As the demand for Bitcoin increases, the price is likely to rise.

What do people think about the Bitcoin halving?

There is a lot of speculation around the Bitcoin halving and its potential effects on the price of Bitcoin. Some people believe that it could lead to a bull run, while others think that it could cause a crash. It’s still too early to say for sure what will happen.

As the date of the next Bitcoin halving approaches, there is a lot of speculation about its potential effects on the price of Bitcoin. Some people believe that it could lead to a bull run, while others think that it could cause a crash. It’s still too early to say for sure what will happen, but the event is sure to be an important milestone in the history of Bitcoin.

Benefits of Bitcoin Halving

Bitcoin halving is an important event that happens every four years. It is a process that reduces the rewards given to miners for confirming Bitcoin transactions. The main aim of this process is to control the supply of Bitcoin in the market and ensure that it does not become too inflationary.

Some people believe that the next Bitcoin halving, which will take place in May 2020, could lead to a surge in the value of Bitcoin. This is because the reduction in rewards will lead to a decrease in the supply of Bitcoin, while the demand for it remains high. As a result, the price of Bitcoin is likely to increase significantly.

Apart from causing a surge in the price of Bitcoin, the next Bitcoin halving could also lead to an increase in its adoption rate. This is because miners will need to start using Bitcoin more efficiently in order to make a profit. As a result, they are likely to start accepting it as a payment method from their customers.

Thus, the next Bitcoin halving is definitely something that you should keep an eye on. If you are thinking of investing in Bitcoin, then this is definitely the time to do so. The potential rewards that you can receive are simply too good to ignore.

Drawbacks of Bitcoin Halving

Bitcoin halving is a process that reduces the reward for mining a new block by half. This event happens approximately every four years and it’s currently scheduled to happen on July 10th, 2020. Some people believe that this could have a negative impact on the price of Bitcoin.

There are several potential drawbacks associated with the Bitcoin halving. Firstly, it could lead to a decrease in the number of new coins being produced, which could negatively impact the price of Bitcoin. Secondly, it could lead to a decrease in the incentive to mine Bitcoin, which could result in less hash power being dedicated to securing the network. Finally, it could lead to increased volatility as traders speculate on how the halving will affect the price of Bitcoin.

Despite these potential drawbacks, the Bitcoin halving could also have some positive effects. For example, it could lead to a decrease in the inflation rate of Bitcoin, which could increase its attractiveness as a store of value. Additionally, it could lead to an increase in the price of Bitcoin as demand for the coin increases. Ultimately, it will be up to market forces to determine how the Bitcoin halving affects the price of Bitcoin and other aspects of the cryptocurrency ecosystem.

As we approach the upcoming Bitcoin halving, it’s important to understand both the potential benefits and drawbacks associated with this event. While there is no guaranteed outcome, it’s likely that the Bitcoin halving will have a significant impact on the price and security of Bitcoin.