Machine learning, Investment, and Personal Finance – An Overview

Gone are the days when you had to depend on manual transactions and use your calculator to find out your profit and loss. Welcome to the era of Artificial Intelligence, Machine learning, and cryptocurrency. This has been a very interesting market given the fact that the returns are extremely good albeit risks and panic among the most experienced of all traders.

Studies have also proved that the cryptocurrency vehicles of investment are way better than the conventional investment vehicles.

Moving away from the cryptocurrency craze to a more generalized discussion about personal finance, apps, and automated trading, this write-up discusses few nuances of the financial markets.

Investment is a psychological process

Despite the fact that investment vehicles are rapidly growing and number of e-wallets is rising by leaps and bounds, yet one thing that has been proved is that it is entirely an emotional process.

Investment is influenced by emotions. You tend to decide either too early or too late about any trade. As a result certain decisions can go against investors when judged on a long term basis. But it has been observed that the stock trading market is so volatile that even if you have survived in it for decades, you still might fail to predict a trade accurately.

It is volatile and dynamic. But thanks to Machine learning, which has at least narrowed down your options as far as predicting a trade is concerned. Nevertheless, “divorcing” emotions from trading is a sensible approach.

App driven investments

These days, you will find an app for almost anything under the sun. Machine learning, which is a form of Artificial Intelligence, is being made use of by businesses of all sizes regardless of whether it is a medium sized organization or a corporate stalwart. For instance, stalwarts like Google and Facebook use it to enhance user experience. There are many mobile apps that have made life easier for investors. These days, Machine learning and personal finance go hand in hand and complement each other.

Automated trading platforms

This automated technology will do away with emotional trading. With the help of automated trading technologies, you can enjoy both qualitative and quantitative edge and this holds true particularly for AI.

It cannot be denied that there is a huge pool of data worldwide and more are being added every second due to global trading. And so called ECNs or Electronic Communication Networks have opened new avenues of trading characterized by “complex algorithms, thereby giving rise to “high frequency trading”.

Regardless of whether you want to trade currencies or any other investment vehicle, automated trading platforms have made things easier for all investors, regardless of whether you are an amateur or a veteran.

For instance, if you are a newcomer and want to try your luck with currency pairs or rather trade in the FX or forex market, these days you get FX brokers that operate on automated trading platforms. They will allow you to trade on demo accounts so that you can get the concept clear and be prepared when you want to trade in real time.

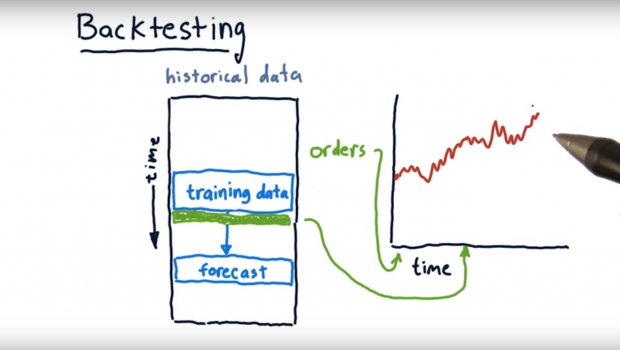

All these automated trading platforms can be regarded as a precursor to Machine learning, which is essentially a form of Artificial Intelligence.

Adapting to AI and Machine learning

With the rapidly changing blockchain ecosystem, Machine learning and Artificial Intelligence have found wide application due to the infrastructure being disparate, architecture that is decentralized, and bulk data being created every second. The need for AI has been established and identified and the businesses that have implemented the same are yielding rich returns.