What Should You Know About the Newest Trends in Cryptocurrency and Ethereum

The world’s two most popular digital currencies, Bitcoin and Ethereum, have been surging in the last six months, competing against each other and reaching unprecedented value. Their popularity has also been on the rise. A recent report by Coinbase and ARK Invest suggested that 10 million people hold a material amount of Bitcoin around the globe.

The latest trends in both digital currencies suggest that they will continue to win over the hearts and wallets of people. Let’s take a closer look at these trends in this article.

Trends in use of Bitcoin and Ethereum

According to the aforementioned report by Coinbase and ARK Investment Management, around 10 million people were using Bitcoin in early 2017. This amount was calculated by analyzing the Coinbase user activity and applied to the overall Bitcoin community.

Given that many people hold the digital currency for its value, it’s sufficient to claim that 10 million is not the exact estimation. It rather shows how many people use it as a medium for exchange. When added with the number of users who prefer to store them, the number of Bitcoin wallets will increase significantly.

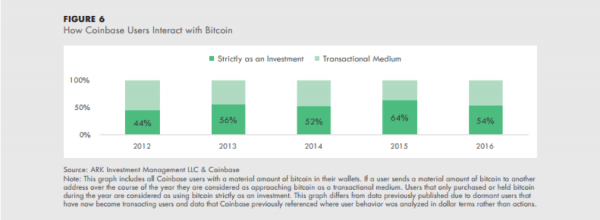

For example, the information released by ARK Investment Management showed that the number of people who prefer not to spend Bitcoin has been holding steadily since 2012 (see graph below).

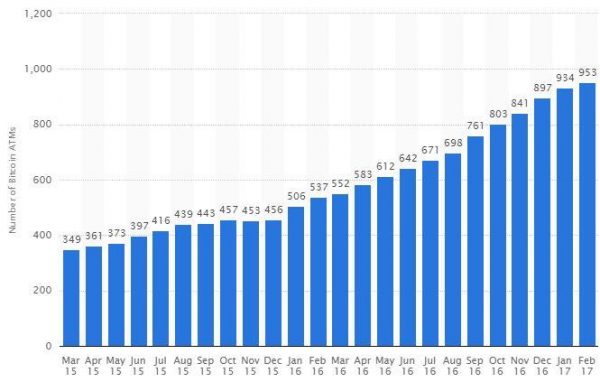

The data from Statista also shows that the Bitcoin community continues to grow in the recent calculations the number of global ATMs:

Image Credit: Statista

On the other hand, an Analytics Platform for Ethereum EtherScan suggested that the currency was used just over a million wallets in early 2017. This might not be an impressive number compared to Bitcoin but everything could change very soon.

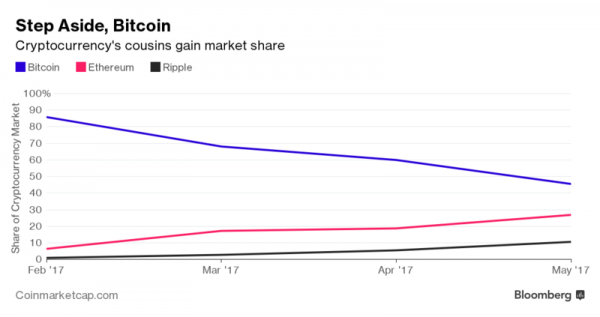

Bloomberg was one of the first to predict a possible overthrowing of Bitcoin as the biggest digital currency. This article published in May stated that Ethereum had “a much richer, organic developer ecosystem” that is “a much more aggressive than Bitcoin’s.”

The data on the market share of both Bitcoin and Ethereum supports the possibility of the latter becoming the most widely used digital currency in the world in near future.

Image credit: Bloomberg

Yes, yes, we know that a Bitcoin now costs about $2,400 a coin, which is still more than ten times the price of Ethereum (some suggests that the cost of Bitcoin will reach $4,400 by the end of 2017). However, as the graph above showed, the second-most popular digital currency is quickly gaining momentum and market share. It’s very likely that Ethereum will continue to improve its position in the nearest future. Some forecast that Ethereum will surpass Bitcoin by 2018.

“It’s clear that both Bitcoin and Ethereum will continue to grow in the next months,” says Tim Whitehouse, a cryptocurrency enthusiast from Bestessaytips. “However, Ethereum should enjoy a much faster development rate.”

Should you invest in Bitcoin or Ethereum?

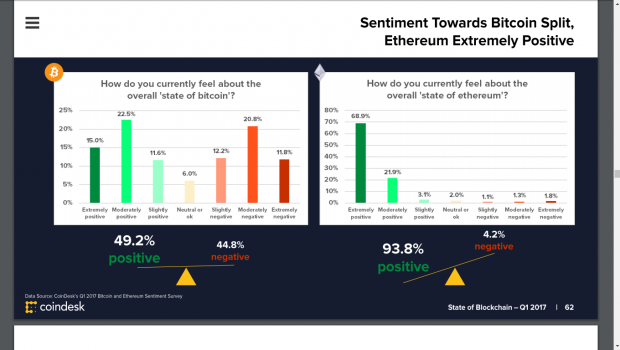

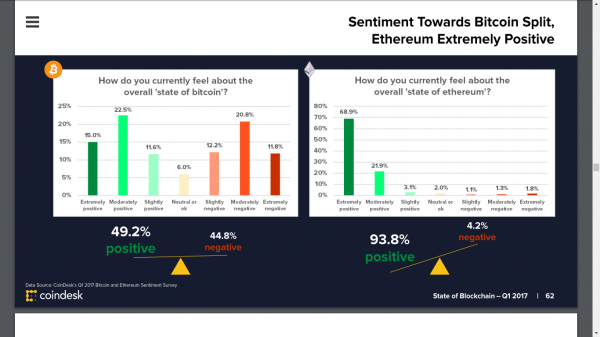

One of the most reputable sources of information related to digital currencies, CoinDesk, released the most recent trends and statistics in its State of Blockchain Q1 2017. It surveyed more than 1,100 blockchain enthusiasts to identify perception around the state of Bitcoin and Ethereum. While there’s lots of great data in this report, the following slide (the 62nd in the report) has caught our attention the most:

Image Credit: Coindesk

93 percent of the participants of the survey reported having a positive outlook for Ethereum. On the other hand, the same was reported only by 49 percent for Bitcoin. There are a number of reasons that can explain such significant difference in sentiment between the two digital currencies, including an outlook for scaling, high fees, and increasing centralization.

This information might be useful for those who plan to invest in either Bitcoin or Ethereum.

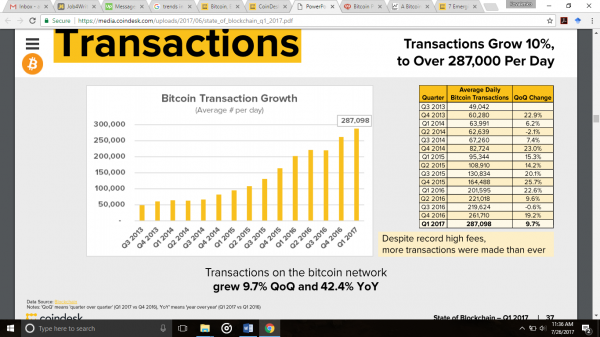

Transactions and Fees on the Risein

State of Blockchain Q1 2017 report has also shown that both digital currencies set records for transactions. For example, the number of daily Bitcoin transactions in the first quarter of 2017 was 287,098:

Image Credit: Coindesk

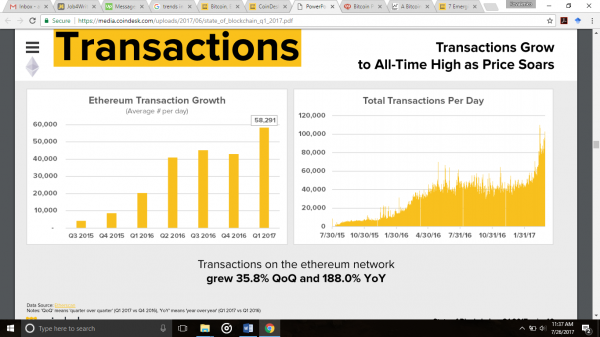

The same could be said about Ethereum as well: 2017 has set a record for the most transactions per day (58,291):

Image Credit: Coindesk

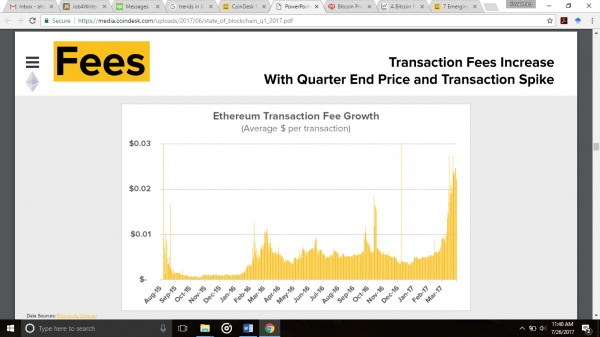

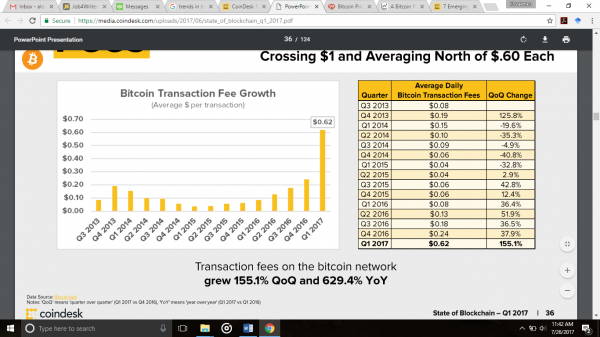

As for the fees for transactions, the difference between the two digital currencies remains significant. However, the fees have increased in both Bitcoin and Ethereum. For example, the fee for an Ethereum transaction nearly reached $0.03 this March.

Image Credit: Coindesk

Bitcoin’s fee for the transaction has increased from $0.09 in Q3 of 2013 to $0.62 in Q1 of 2017. With the number of transactions on the rise, it’s safe to assume that the fee will increase a bit as well.

Image Credit: Coindesk

Conclusion

We are very cautious about the forecast of the price for both currencies but it seems that Ethereum might just surpass the current leader, Bitcoin, within the next year. At this point, it is apparent that their value will continue to increase along with the number of global users.

About the author:

Tom Jager is professional blogger. He works at Proessaywriting. He has degree in Law and English literature. Tom has written numerous articles/online journals. You can reach him at G+ or Facebook.

![Bring Your Case to Life [Infographic]](https://technofaq.org/wp-content/uploads/2016/08/Bring-Your-Case-To-Life-150x150.jpg)