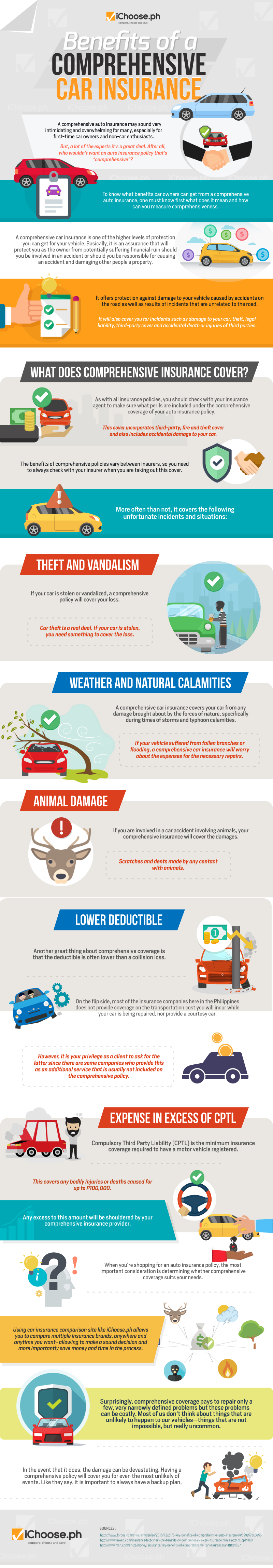

Benefits of Comprehensive Car Insurance [Infographic]

As a car owner, you are more than likely to be mulling over the prospect of purchasing insurance for your vehicle on top of whatever insurance that the law requires you to have. One of your options is called a “comprehensive car insurance”, which you may have heard before. Truth be told, many drivers are intimidated by how it sounds – especially if they are first-time car owners or non-car enthusiasts – but experts will tell you that it’s actually a big deal for many car owners everywhere.

It’s vital that you are equipped with the clear understanding of what the comprehensive coverage means. The Insurance Services Offices (ISO) – an insurance industry support, rating, and information organization – states that there are two main categories of covered physical damage losses, including collision damage losses and losses other than collision. These two categories are referred to as a “collision coverage” and a “comprehensive coverage”.

Comprehensive car insurances cover a number of perils depending on what the insurance has indicated. However, the most common incorporations are third-party, fire, theft, and accidental damage. Again, the benefits vary between insurers, which makes it imperative that you find out what yours cover (or will cover).

In the event that your car is damaged for a number of situations that a comprehensive car insurance covers, you can claim from your insurer compensation for the repairs that your car will have to undergo to bring it back to its original condition. Without it, you’ll have to shell out money yourself, and depending on your status and the damages, may be shockingly expensive. To avoid getting stuck with a big bill, consider your car insurance provider as well. Freeway Insurance offers cheap car insurance and full coverage so you do not overpay for proper protection.

A surprising note about comprehensive car insurance is the fact that it can be cheaper, or just as cheap, as that of a third-party one. Confused.com says that this can be brought upon by a rise in third-party policies due to so many people availing of it that makes the overall cost of that cover to go up. In short, there comes a point that they may match or even overtake a comprehensive car insurance’s costs. Of course, this is a case-to-case basis and may be different for other third-party policies or comprehensive car insurances, so it pays to do extra research on what you’re getting.

Learn more about comprehensive car insurances by checking out this infographic by iChoose.ph: