The Big Bang of FinTech Has Yet to Materialize in the Massive Insurance Industry

The insurance industry is soon celebrating its 335 year anniversary from the founding of Lloyds of London that originally met in a London coffeehouse to insure trading ventures and shipping concerns. Yet the sad part of this venerable milestone is the fact that there has been very little innovation or change in one of the world’s largest industries. At $3.7 trillion in value, this global super business that is larger than all other financial segments combined should be more cutting edged. Insurance itself was a revolutionary concept when Edward Lloyd created it, and finally a new revolution has exploded on to the scene. This is FinTech, or financial technology. This sea change is still grossly underrepresented in this most foundational of economic industries.

What Is FinTech Exactly?

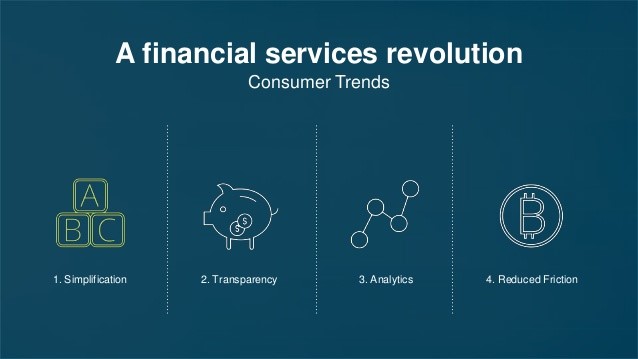

Fin Tech’s ultimate goal is to utilize the three foundations of data, persistence, and customer-oriented focus to solve problems, as with the example of hadoop reporting. This is particularly important in the mega-field of insurance, which has one of the lowest satisfaction rates, especially after the financial crisis and crash of 2008. In fact, opinions of insurance companies are so low Morgan Stanley found in recent research that online experience customer satisfaction ranks ahead of only the telecoms and real estate survey in the sixteen industry table of consumer-related businesses.

How Can FinTech Save Insurance’s Public Perception?

The venerable old insurance business that employs 315,000 people needs desperately to be modernized with technology, and FinTech offers results through data science to provide superior service, products, and even pricing. Insurance is founded on data and old school actuarial tables and science, so there is much that Financial Technology firms can offer.

Why Are Financial Technology Firms Challenged to Break Into the Industry?

The first problem is one of attitude. The insurance industry has been stubbornly refusing to accommodate to the sea change that is needed to improve the all-important customer service experience. This is somewhat surprising in an industry whose data is collected, processed, and analyzed mostly by computers. Adherents and priests of the actuarial science on which insurance is based stubbornly refuse to modernize and accept the major changes FinTech promises.

Where Are the Tech Startups in the Insurance Industry?

The good news is that there are significant investments being made in this critical and groundbreaking industry. More than $5.4 billion has made its way into British FinTech firms since 2010. This is fitting and right for the city of London which is both the world leader in banking and the legacy-holding insurance center of the globe. Yet much more needs to be invested and greater results should come from the investments that have been made so far. A few success stories exist, yet they are still too few.

Insurance comparison and search engines like Compare the Market, Moneysupermarket, and Check24 have fundamentally changed the ways customers uncover and meet their providers of insurance. Younger drivers have embraced Black Box Insurance which is actually rooted in telematics data. This has led to the rise of Marmalade and InsureTheBox, allowing consumers to compare car insurance quotes.

Part of the barriers to entering the insurance business is the massive capital requirements. Only to launch an insurance enterprise needs an unimaginable amount of money to satisfy possible claims from customers. EU regulation is stringent. Thanks to the Solvency II Directive mandated by the European Commission, capital requirements for insurers are at a very high standard for a company to be categorized as a legitimate provider of insurance. Fronting this amount of cash is not easy. Yet companies in the world of banking managed it in recent years with the unlikely success of FinTech banking interlopers Atom and Metro pulling licenses and managing to bank the necessary regulatory capital to start up.

How Can FinTech Address the Problems?

Clearly, there have been dramatic success stories in FinTech pertaining to insurance and banking. This should encourage potential entrepreneurs in the insurance tech industry and increase desire from the London-based venture capitalists to pour money into the insurance sector. Gradually other companies like BoughtByMany, The Floow, and QuanTemplate are proving to the financial world that the miracle of technology can successfully and positively change up the insurance industry. Digital insurance is one field they can make further improvements and inroads into to prove their worth to the financial giants and the insurance industry as a whole.

Insurance giant AXA shines as an example of one insurance conglomerate opening up to the possibilities. They launched Kamet recently. This accelerator program whose goal is to foster insurance technology entrepreneurs started with €100 Euros in funds. London has the necessary combined ingredients of legacy and tradition, existing giants in the field, the talent pool of entrepreneurs and workers, and the venture capital base to make this city the undisputed master of the FinTech universe. All missing now is the appearance of the brave and willing entrepreneurs. Wherever they are hiding, please stand up.