Mobile payments call for legal framework

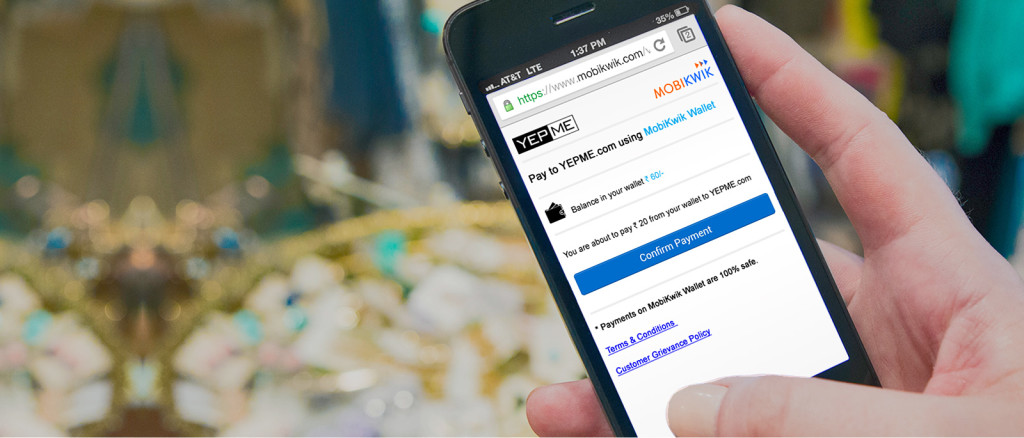

Mobile payments are termed as the payments that are transmitted by access devices and are connected to mobile communication networks. In this, money basically originates from two major sources, including customer funds which are present at banks in the form of deposit account or customer stored value funds maintained by mobile network operators. Online payments including paying for your online recharge (such as Tata Sky recharge) are entirely different from traditional payment methods as these traditional payment systems are generally dominated by financial institutions, usually banks.

With the rise of internet, new payment techniques were developed in order to deal with the specifications of online context. Besides, e-money continued to be a risk factor with the issue of legal hurdles which result into technical as well as psychological barriers. In this, you cannot always guarantee security of transaction, thus it suffers from lack of market confidence till date. There are five key risks that are sometimes involved in e-banking. Such as:

Legal Regime: There is an uncertainty that the mobile payment services might be unlicensed. A sound legal basis establishes an effective oversight framework to monitor the potential risks and balances development.

Financial Integrity: Mobile payments are considered an important tool for reducing the reliance on the use of anonymous cash. However, mobile payments increase the risk to money laundering. To address this issue, FATF (Financial Action Task Force) provides the room for flexibility and enables the banking institutions to craft more effective controls without compromising on financial inclusion. Furthermore, AML/ CFT risks must be adequately addressed so as to protect customers from the same.

Surely, mobile payments are a new age payment syndrome, thus you need proper regulations and guidelines for mobile payments. Additionally, there should be valid policies for internet and phone banking. There might be new innovations on daily basis, but there is lack of technology standards and it gave rise to a lot of fragmented versions to address mobile payments offered by financial institutions.

As mobile payments allow parties to economic transactions thus it can be one of the main reasons why consumers are not able to adopt mobile payments since now. There are many retailers who are now concerned about security issues, considering this EMV (EuroPay, Master card, Visa) has already developed secure chips for transmitting the data. The major trick is that retailers need to create multilevel security type so as protect themselves in the virtual world.

There are some safety tricks that can make your transactions safe and secure, like:

- You must download apps from trustworthy sources

- Always check for the ratings and reviews beforehand

- Keep passwords on your mobile phones so that no one can access your device without permission

- Ensure that you are using HTTPS

- Send data over a secure and safe internet connection

- Always choose a dependable name while downloading applications on internet

Apart from this, educating the customer is very necessary while using internet applications. Possibility is that understanding the technical terms might be difficult for many individuals before downloading, thus you must read terms and conditions properly before making financial agreements. This way, online payments can be a secure platform for both customers and retailers.